Question: Question 1 (1 point) When we want to measure a firm's capital structure, we will use WACC as we want to weight the quantity and

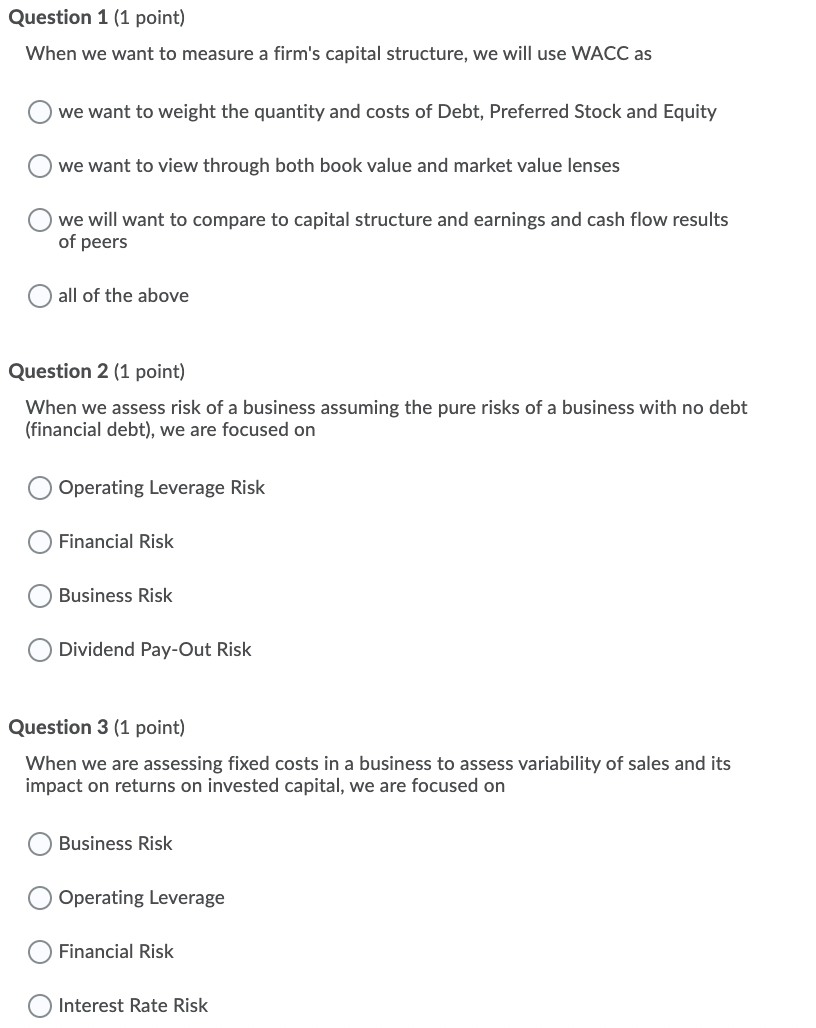

Question 1 (1 point) When we want to measure a firm's capital structure, we will use WACC as we want to weight the quantity and costs of Debt, Preferred Stock and Equity we want to view through both book value and market value lenses we will want to compare to capital structure and earnings and cash flow results of peers all of the above Question 2 (1 point) When we assess risk of a business assuming the pure risks of a business with no debt (financial debt), we are focused on Operating Leverage Risk Financial Risk Business Risk Dividend Pay-Out Risk Question 3 (1 point) When we are assessing fixed costs in a business to assess variability of sales and its impact on returns on invested capital, we are focused on Business Risk Operating Leverage Financial Risk Interest Rate Risk Question 1 (1 point) When we want to measure a firm's capital structure, we will use WACC as we want to weight the quantity and costs of Debt, Preferred Stock and Equity we want to view through both book value and market value lenses we will want to compare to capital structure and earnings and cash flow results of peers all of the above Question 2 (1 point) When we assess risk of a business assuming the pure risks of a business with no debt (financial debt), we are focused on Operating Leverage Risk Financial Risk Business Risk Dividend Pay-Out Risk Question 3 (1 point) When we are assessing fixed costs in a business to assess variability of sales and its impact on returns on invested capital, we are focused on Business Risk Operating Leverage Financial Risk Interest Rate Risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts