Question: Question 1 1 points Save Answer A 10-year semiannual coupon-ed bond with a coupon rate of 7% and a face value of $1000 was sold

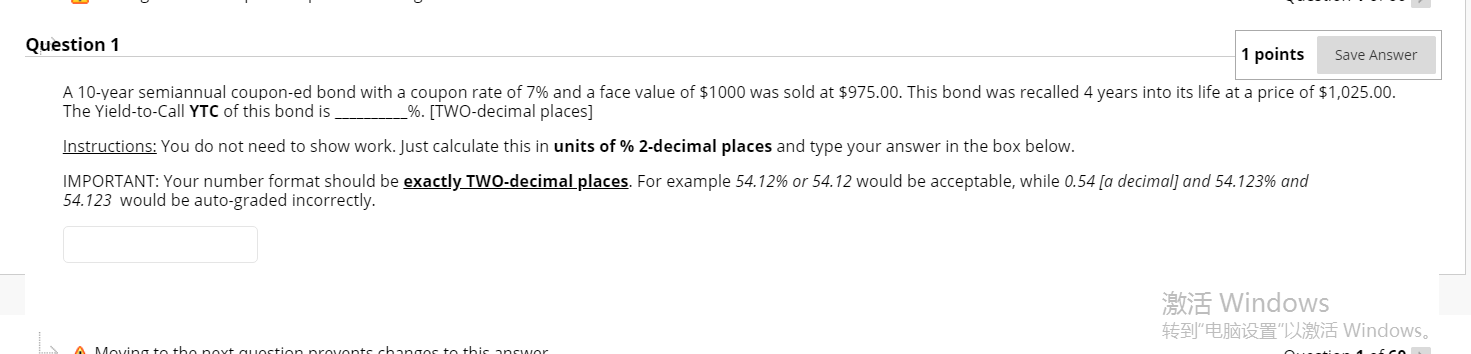

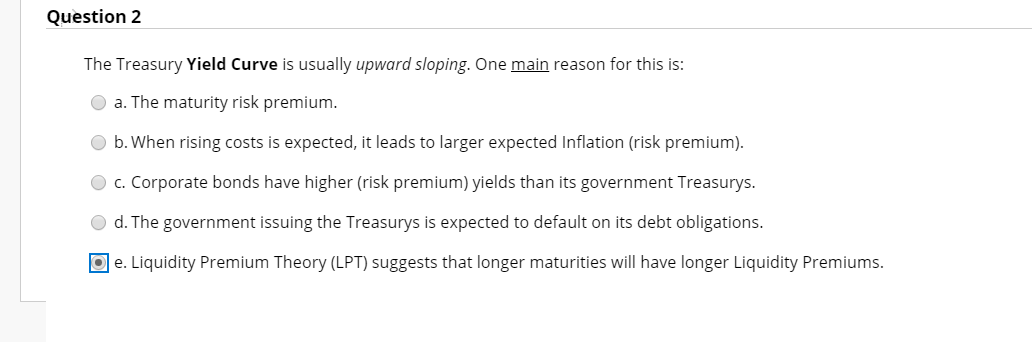

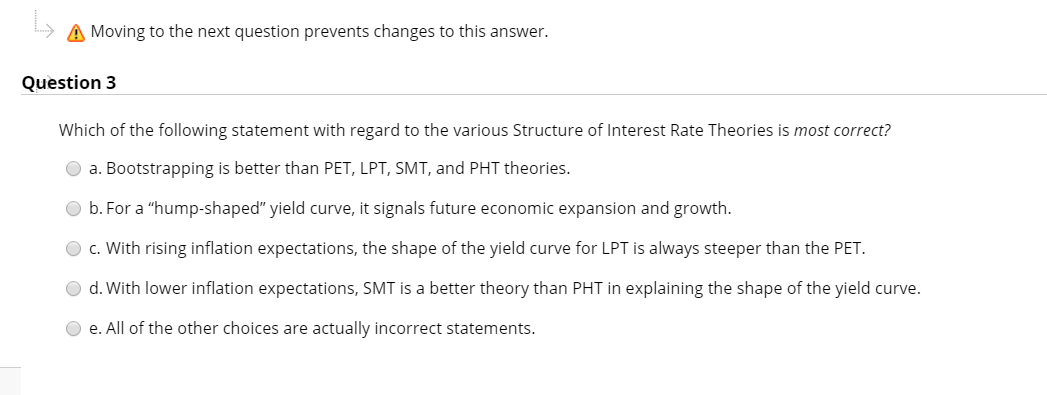

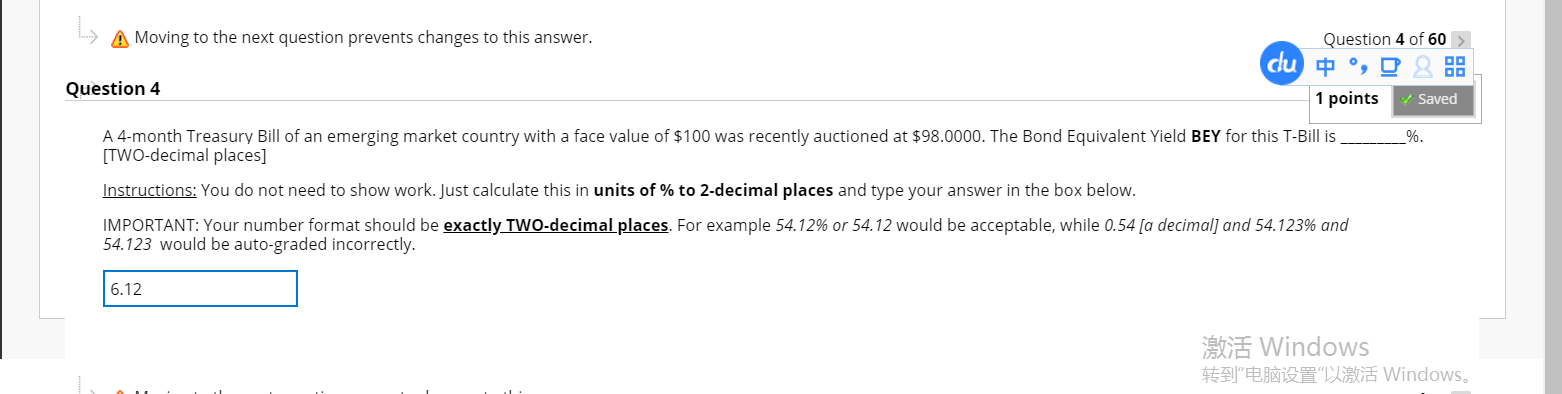

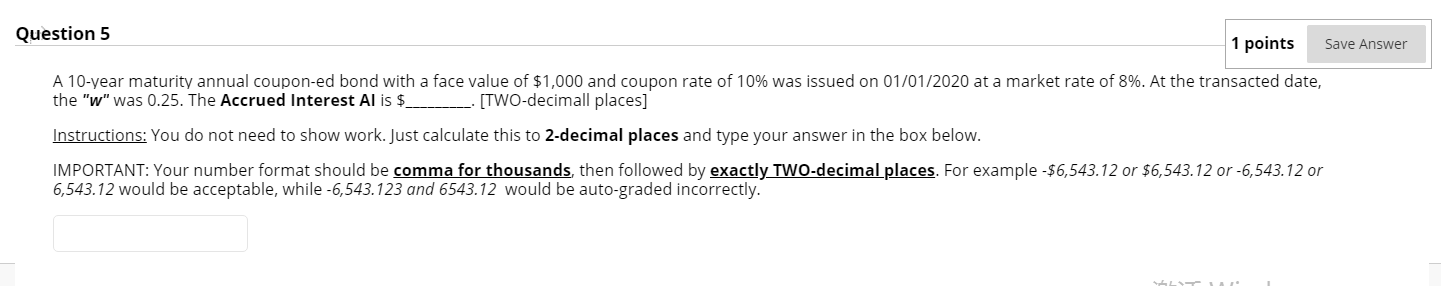

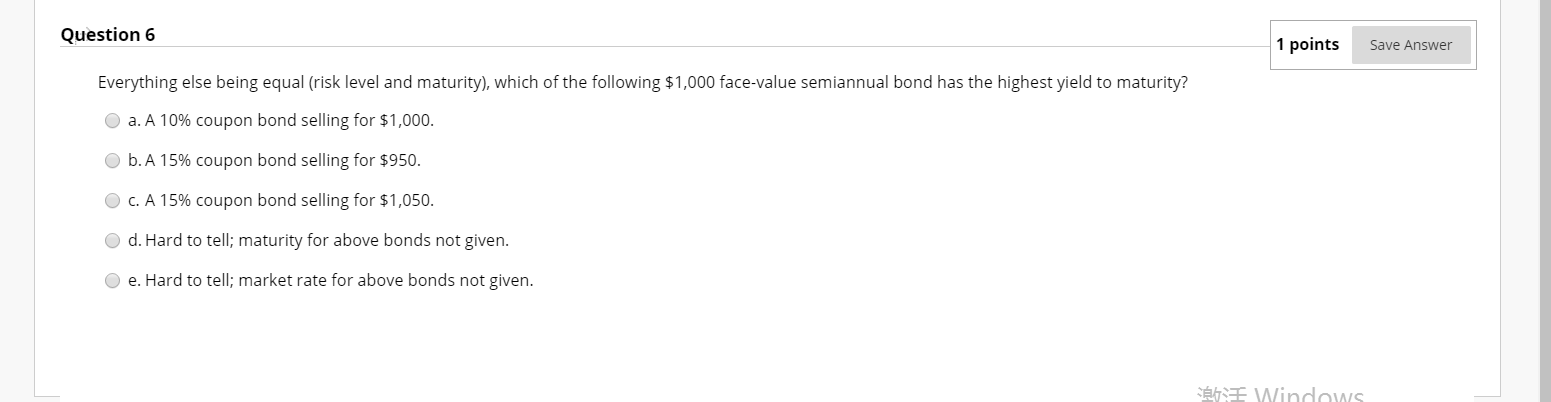

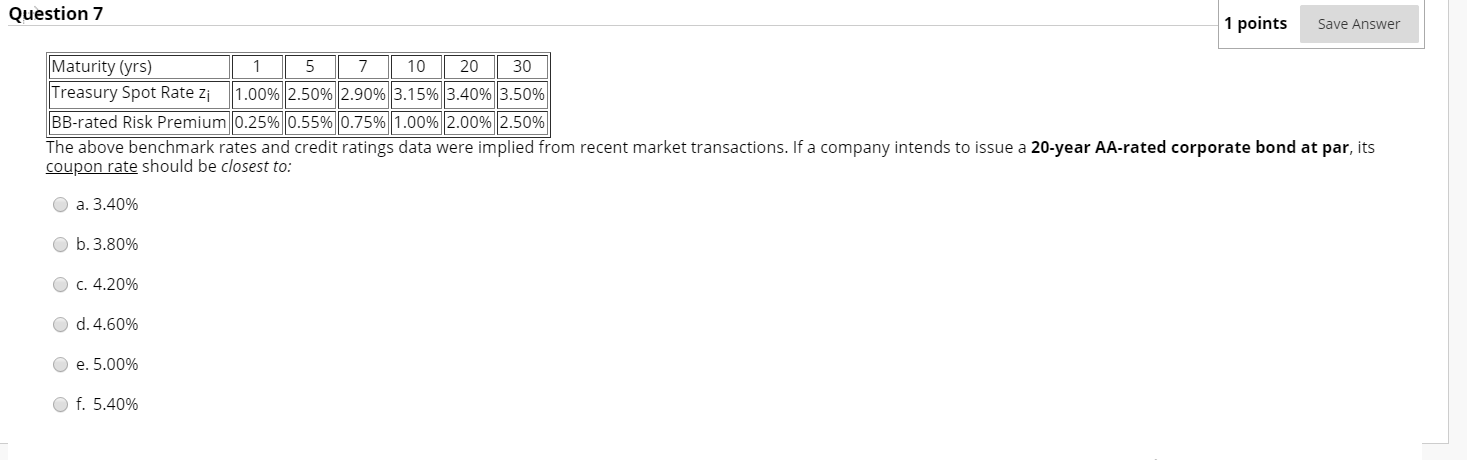

Question 1 1 points Save Answer A 10-year semiannual coupon-ed bond with a coupon rate of 7% and a face value of $1000 was sold at $975.00. This bond was recalled 4 years into its life at a price of $1,025.00. The Yield-to-Call YTC of this bond is %. [TWO-decimal places) Instructions: You do not need to show work. Just calculate this in units of % 2-decimal places and type your answer in the box below. IMPORTANT: Your number format should be exactly TWO-decimal places. For example 54.12% or 54.12 would be acceptable, while 0.54 [a decimal) and 54.123% and 54.123 would be auto-graded incorrectly. em Windows " EL Windows. A Moving to the novt quction provonte changes to this wor Question 2 The Treasury Yield Curve is usually upward sloping. One main reason for this is: a. The maturity risk premium. b. When rising costs is expected, it leads to larger expected Inflation (risk premium). c. Corporate bonds have higher risk premium) yields than its government Treasurys. d. The government issuing the Treasurys is expected to default on its debt obligations. Oe. Liquidity Premium Theory (LPT) suggests that longer maturities will have longer Liquidity Premiums. A Moving to the next question prevents changes to this answer. Question 3 Which of the following statement with regard to the various Structure of Interest Rate Theories is most correct? a. Bootstrapping is better than PET, LPT, SMT, and PHT theories. b. For a "hump-shaped" yield curve, it signals future economic expansion and growth. c. With rising inflation expectations, the shape of the yield curve for LPT is always steeper than the PET. d. With lower inflation expectations, SMT is a better theory than PHT in explaining the shape of the yield curve. e. All of the other choices are actually incorrect statements. A Moving to the next question prevents changes to this answer. Question 4 of 60 du Question 4 1 points Saved _%. A 4-month Treasury Bill of an emerging market country with a face value of $100 was recently auctioned at $98.0000. The Bond Equivalent Yield BEY for this T-Bill is [TWO-decimal places] Instructions: You do not need to show work. Just calculate this in units of % to 2-decimal places and type your answer in the box below. IMPORTANT: Your number format should be exactly TWO-decimal places. For example 54.12% or 54.12 would be acceptable, while 0.54 [a decimal) and 54.123% and 54.123 would be auto-graded incorrectly. 6.12 Windows Windows Question 5 1 points Save Answer A 10-year maturity annual coupon-ed bond with a face value of $1,000 and coupon rate of 10% was issued on 01/01/2020 at a market rate of 8%. At the transacted date, the "w" was 0.25. The Accrued Interest Al is $ [TWO-decimall places] Instructions: You do not need to show work. Just calculate this to 2-decimal places and type your answer in the box below. IMPORTANT: Your number format should be comma for thousands, then followed by exactly TWO-decimal places. For example - $6,543.12 or $6,543.12 or -6,543.12 or 6,543.12 would be acceptable, while -6,543.123 and 6543.12 would be auto-graded incorrectly. Question 6 1 points Save Answer Everything else being equal (risk level and maturity), which of the following $1,000 face-value semiannual bond has the highest yield to maturity? a. A 10% coupon bond selling for $1,000. b. A 15% coupon bond selling for $950. c. A 15% coupon bond selling for $1,050. d. Hard to tell; maturity for above bonds not given. e. Hard to tell; market rate for above bonds not given. Windows Question 7 1 points Save Answer 5 Maturity (yrs) 1 7 10 20 30 Treasury Spot Rate zi 1.00% 2.50% 2.90%3.15% 3.40% 3.50% BB-rated Risk Premium 0.25% 0.55% 0.75% 1.00% 2.00% 2.50% The above benchmark rates and credit ratings data were implied from recent market transactions. If a company intends to issue a 20-year AA-rated corporate bond at par, its coupon rate should be closest to: O a. 3.40% O b. 3.80% C. 4.20% O d. 4.60% O e. 5.00% O f. 5.40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts