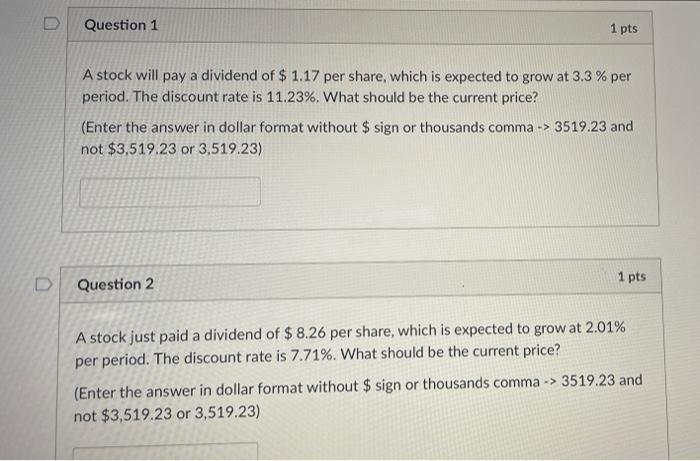

Question: Question 1 1 pts A stock will pay a dividend of $ 1.17 per share, which is expected to grow at 3.3 % per period.

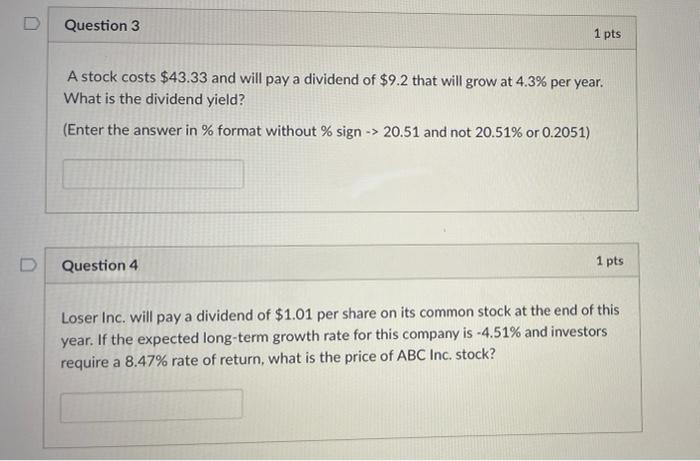

Question 1 1 pts A stock will pay a dividend of $ 1.17 per share, which is expected to grow at 3.3 % per period. The discount rate is 11.23%. What should be the current price? (Enter the answer in dollar format without $ sign or thousands comma -> 3519.23 and not $3,519.23 or 3,519.23) 1 pts D Question 2 A stock just paid a dividend of $ 8.26 per share, which is expected to grow at 2.01% per period. The discount rate is 7.71%. What should be the current price? (Enter the answer in dollar format without $ sign or thousands comma -> 3519.23 and not $3,519.23 or 3,519.23) Question 3 1 pts A stock costs $43.33 and will pay a dividend of $9.2 that will grow at 4.3% per year. What is the dividend yield? (Enter the answer in % format without % sign -> 20.51 and not 20.51% or 0.2051) 1 pts D Question 4 Loser Inc. will pay a dividend of $1.01 per share on its common stock at the end of this year. If the expected long-term growth rate for this company is -4.51% and investors require a 8.47% rate of return, what is the price of ABC Inc. stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts