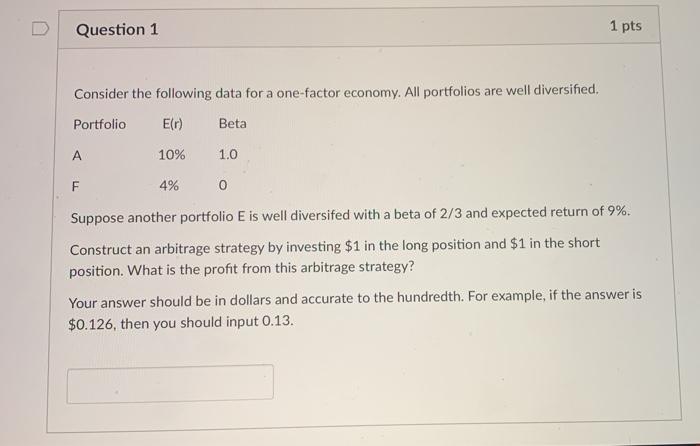

Question: Question 1 1 pts Consider the following data for a one-factor economy. All portfolios are well diversified. Portfolio E() Beta 10% 1.0 F 4% 0

Question 1 1 pts Consider the following data for a one-factor economy. All portfolios are well diversified. Portfolio E() Beta 10% 1.0 F 4% 0 Suppose another portfolio E is well diversifed with a beta of 2/3 and expected return of 9%. Construct an arbitrage strategy by investing $1 in the long position and $1 in the short position. What is the profit from this arbitrage strategy? Your answer should be in dollars and accurate to the hundredth. For example, if the answer is $0.126, then you should input 0.13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts