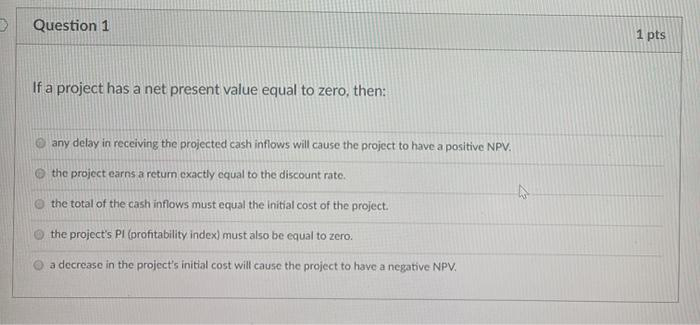

Question: Question 1 1 pts If a project has a net present value equal to zero, then: any delay in receiving the projected cash inflows will

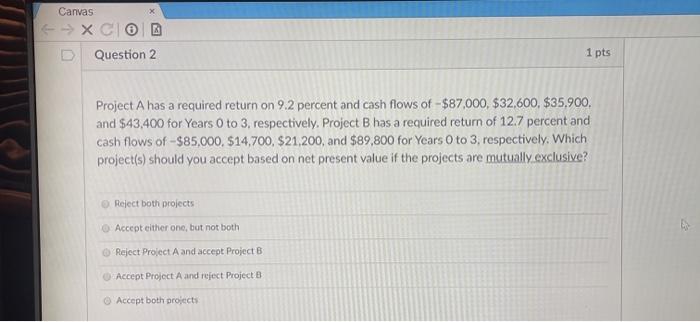

Question 1 1 pts If a project has a net present value equal to zero, then: any delay in receiving the projected cash inflows will cause the project to have a positive NPV. the project earns a retum exactly equal to the discount rate. the total of the cash inflows must equal the initial cost of the project. the project's Pl (profitability index) must also be equal to zero. a decrease in the project's initial cost will cause the project to have a negative NPV, X Canvas --> XCOR Question 2 1 pts Project A has a required return on 9.2 percent and cash flows of - $87,000, $32,600, $35,900, and $43,400 for Years 0 to 3, respectively. Project B has a required return of 12.7 percent and cash flows of -$85,000, $14,700, $21,200, and $89,800 for Years 0 to 3, respectively. Which project(s) should you accept based on net present value if the projects are mutually exclusive? Reject both projects Accept either one, but not both Reject Project A and accept Project B Accept Project A and reject Project Accept both projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts