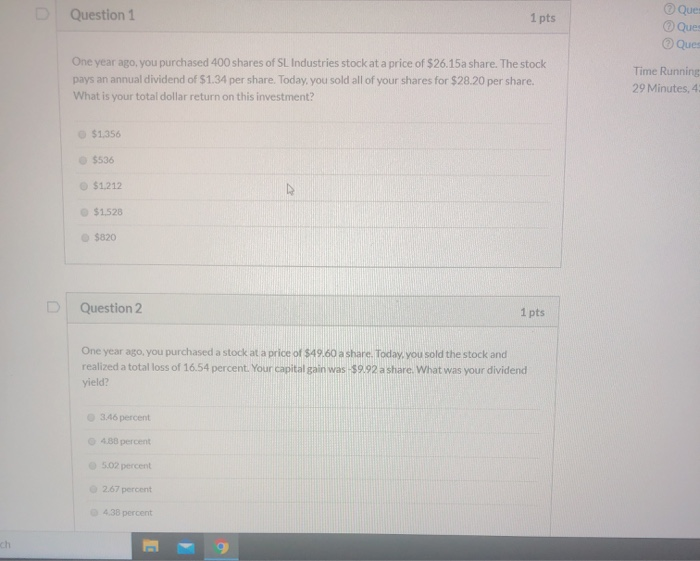

Question: Question 1 1 pts Que Que Que One year ago, you purchased 400 shares of SL Industries stock at a price of $26.15a share. The

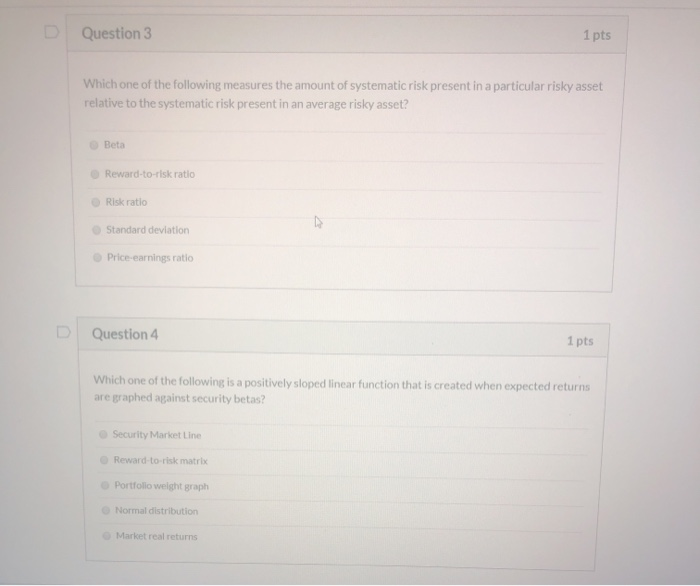

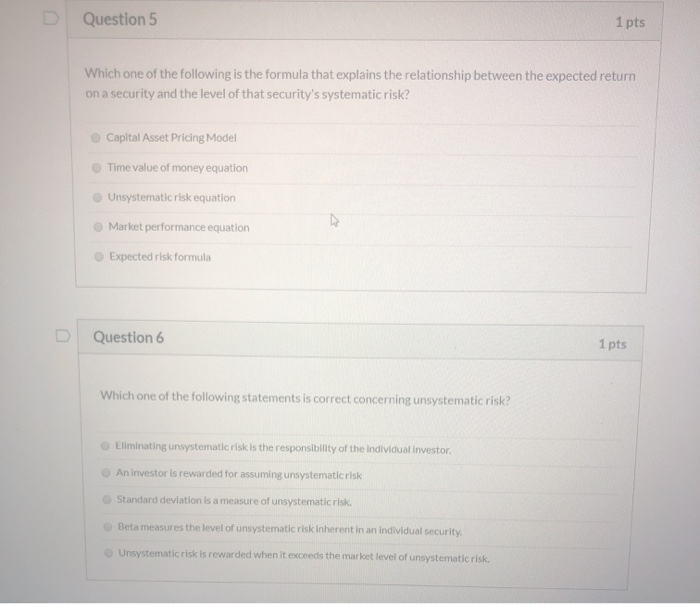

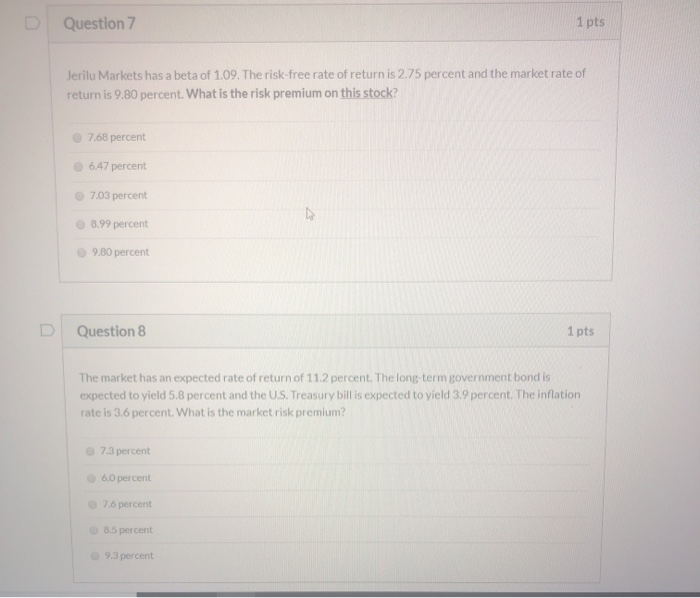

Question 1 1 pts Que Que Que One year ago, you purchased 400 shares of SL Industries stock at a price of $26.15a share. The stock pays an annual dividend of $1.34 per share. Today, you sold all of your shares for $28.20 per share. What is your total dollar return on this investment? Time Running 29 Minutes, 4 $1.356 5536 $1,212 $1.528 $820 Question 2 1 pts One year ago, you purchased a stock at a price of $49.60 a share. Today, you sold the stock and realized a total loss of 16.54 percent. Your capital gain was $9092 a share. What was your dividend yield? 3:46 percent O 4.30 percent 5.02 percent 267 percent Question 3 1 pts Which one of the following measures the amount of systematic risk present in a particular risky asset relative to the systematic risk present in an average risky asset? Beta Reward-to-risk ratio Risk ratio Standard deviation Price earnings ratio Question 4 pts Which one of the following is a positively sloped linear function that is created when expected returns are graphed against security betas? Security Market Line Reward-to-risk matrix Portfolio weight graph Normal distribution Market real returns Question 5 1 pts Which one of the following is the formula that explains the relationship between the expected return on a security and the level of that security's systematic risk? Capital Asset Pricing Model Time value of money equation Unsystematic risk equation Market performance equation Expected risk formula Question 6 1 pts Which one of the following statements is correct concerning unsystematic risk? Eliminating unsystematic risk is the responsibility of the individual investor An Investor is rewarded for assuming unsystematic risk Standard deviation is a measure of unsystematic risk Beta measures the level of unsystematic risk inherent in an individual security Unsystematic risk is rewarded when it exceeds the market level of unsystematic risk. Question 7 1 pts Jerilu Markets has a beta of 1.09. The risk-free rate of return is 2.75 percent and the market rate of return is 9.80 percent. What is the risk premium on this stock 7.68 percent 6.47 percent 7.03 percent 8.99 percent 9.80 percent Question 8 1 pts The market has an expected rate of return of 11.2 percent. The long term government bond is expected to yield 5.8 percent and the U.S. Treasury bill is expected to yield 3.9 percent. The inflation rate is 3.6 percent. What is the market risk premium? 7.3 percent 6.0 percent 7.6 percent 8.5 percent 9.3 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts