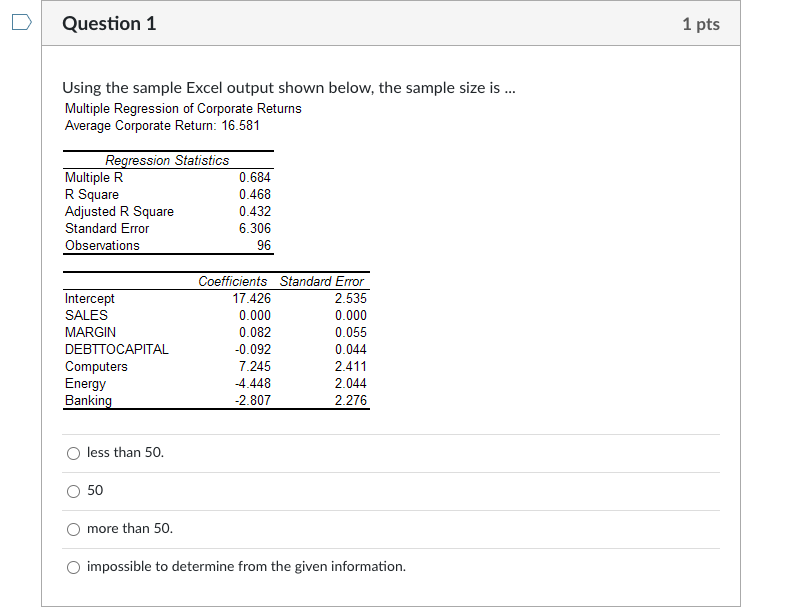

Question: Question 1 1 pts Using the sample Excel output shown below, the sample size is ... Multiple Regression of Corporate Returns Average Corporate Return: 16.581

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock