Question: Question 1 1 pts When an employer sets a maximum amount of benefits an employee receives, but lets the employee select which specific benefits to

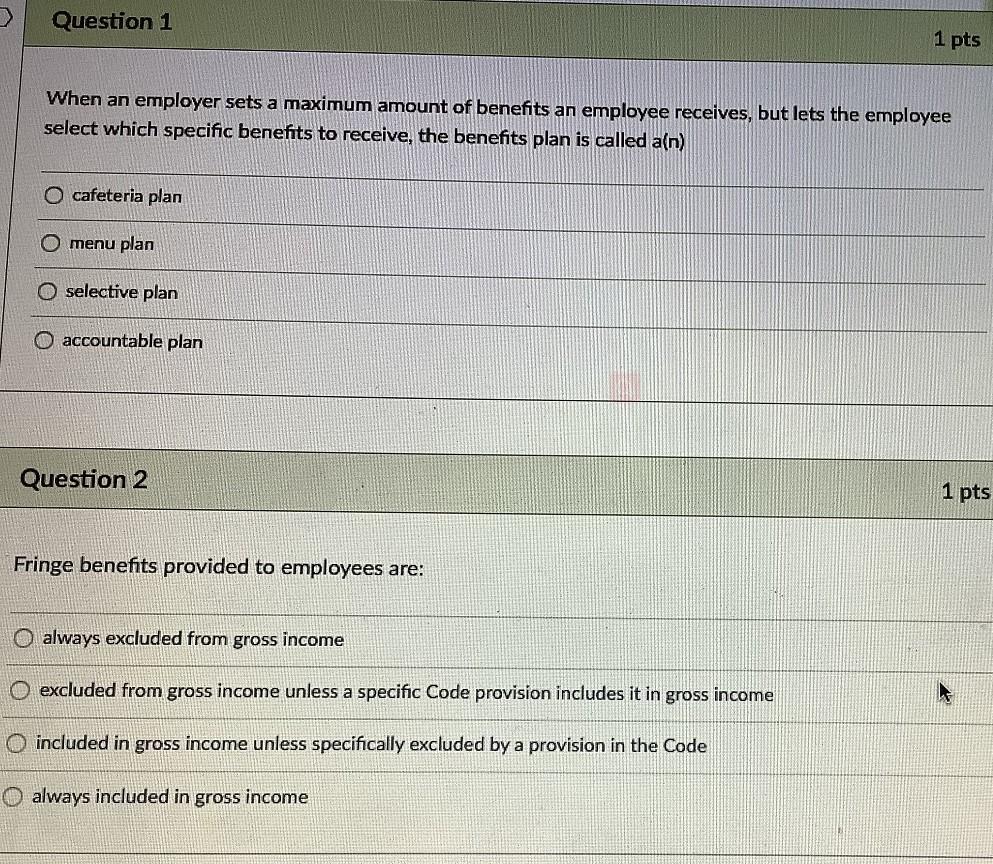

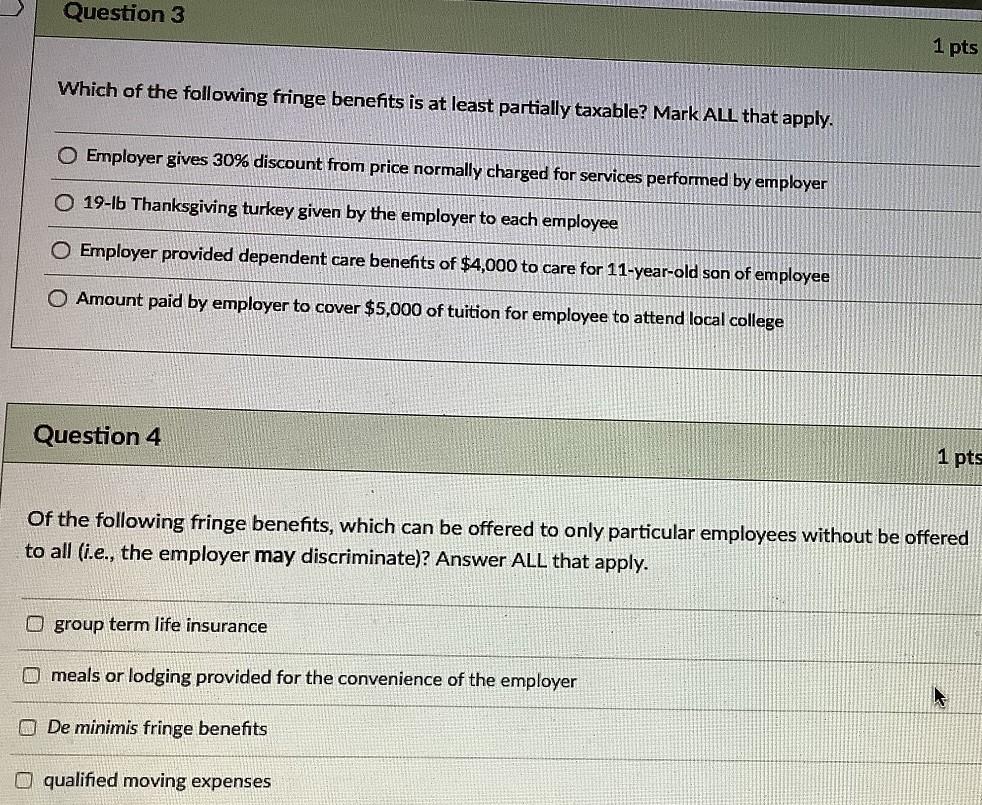

Question 1 1 pts When an employer sets a maximum amount of benefits an employee receives, but lets the employee select which specific benefits to receive, the benefits plan is called a(n) O cafeteria plan O menu plan selective plan o accountable plan Question 2 1 pts Fringe benefits provided to employees are: O always excluded from gross income O excluded from gross income unless a specific Code provision includes it in gross income O included in gross income unless specifically excluded by a provision in the Code always included in gross income Question 3 1 pts Which of the following fringe benefits is at least partially taxable? Mark ALL that apply. O Employer gives 30% discount from price normally charged for services performed by employer O 19-lb Thanksgiving turkey given by the employer to each employee O Employer provided dependent care benefits of $4,000 to care for 11-year-old son of employee O Amount paid by employer to cover $5,000 of tuition for employee to attend local college Question 4 1 pts Of the following fringe benefits, which can be offered to only particular employees without be offered to all (i.e., the employer may discriminate)? Answer ALL that apply. O group term life insurance O meals or lodging provided for the convenience of the employer O De minimis fringe benefits qualified moving expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts