Question: Question 1. (10 marks) ABC insurance company is using a quota share treaty reinsurance to transfer some of the risks to its reinsurer, XYZ reinsurance

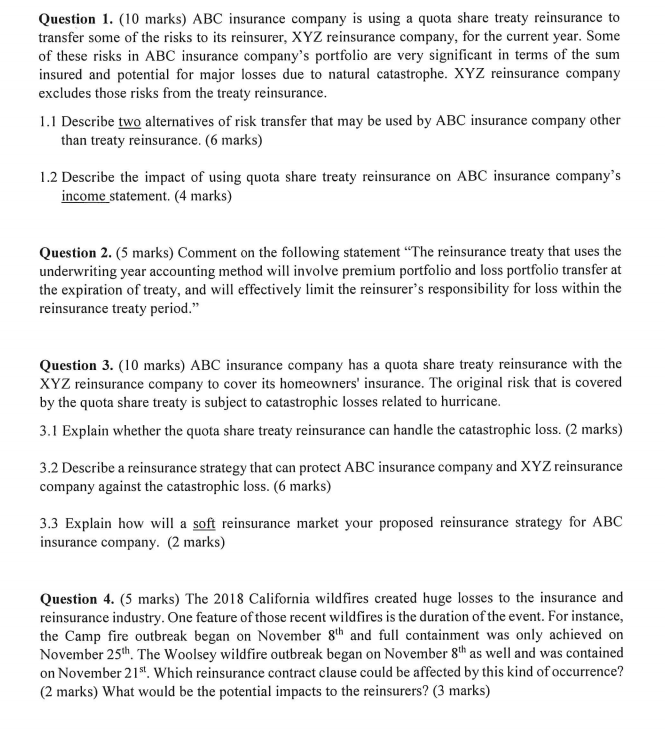

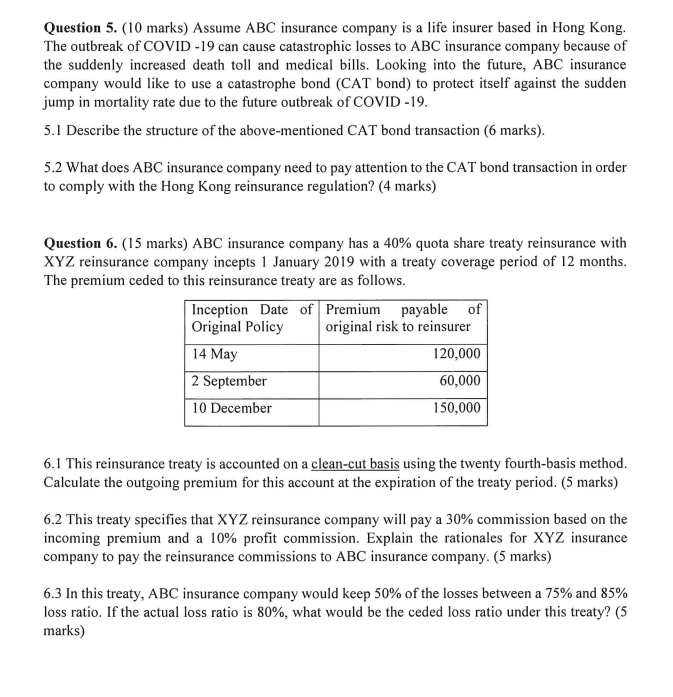

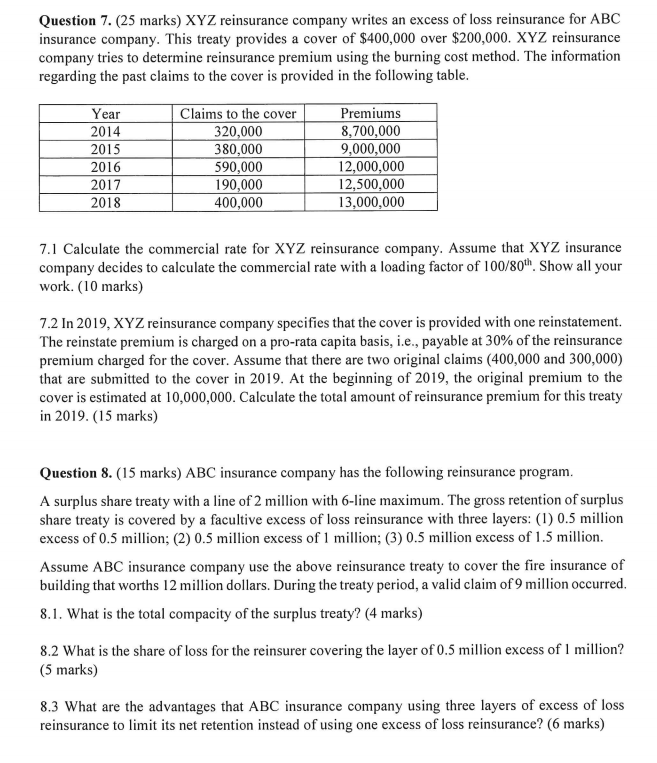

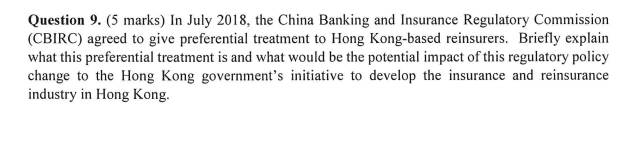

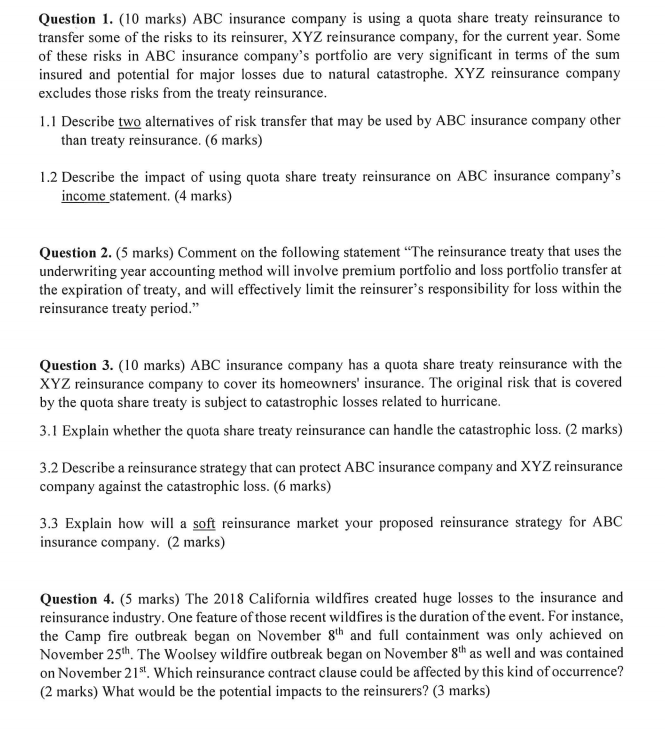

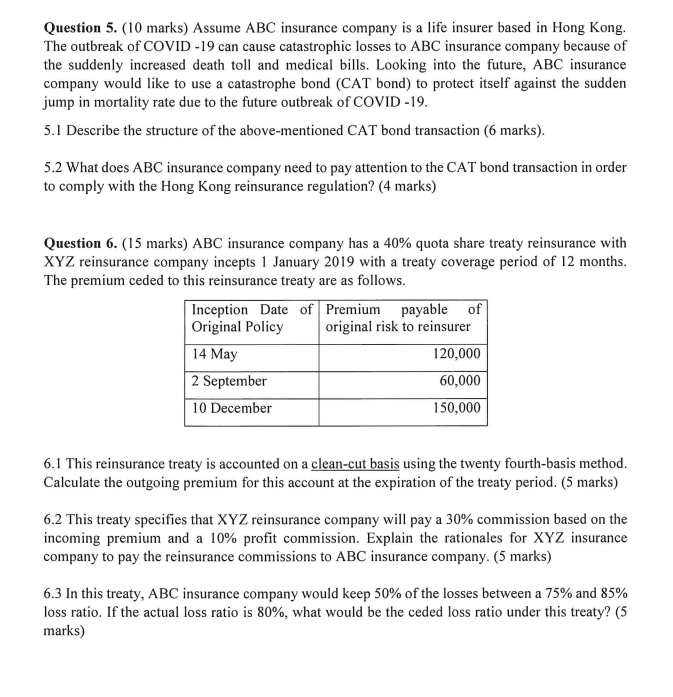

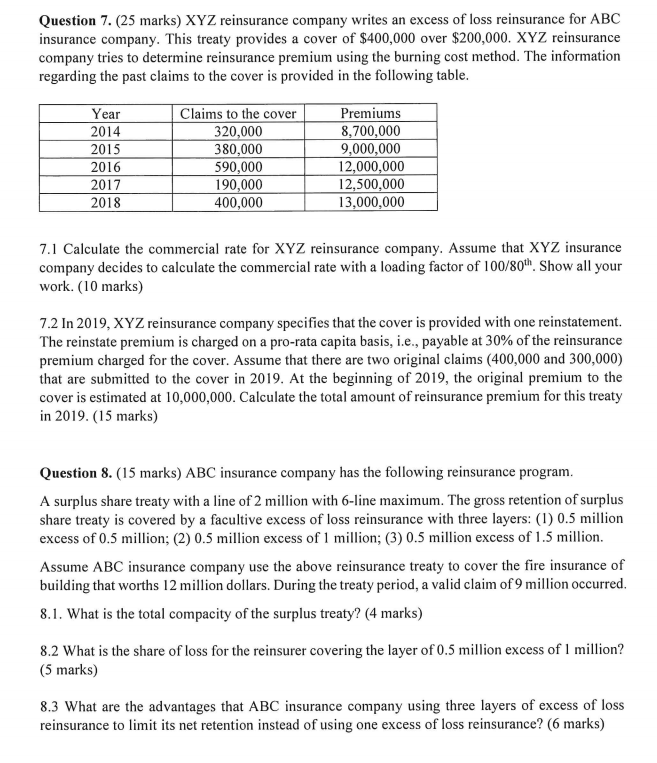

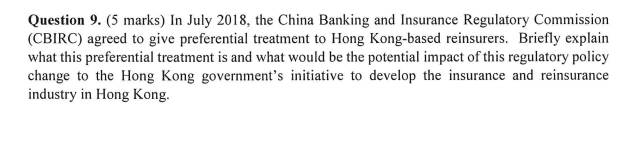

Question 1. (10 marks) ABC insurance company is using a quota share treaty reinsurance to transfer some of the risks to its reinsurer, XYZ reinsurance company, for the current year. Some of these risks in ABC insurance company's portfolio are very significant in terms of the sum insured and potential for major losses due to natural catastrophe. XYZ reinsurance company excludes those risks from the treaty reinsurance. 1.1 Describe two alternatives of risk transfer that may be used by ABC insurance company other than treaty reinsurance. (6 marks) 1.2 Describe the impact of using quota share treaty reinsurance on ABC insurance company's income statement. (4 marks) Question 2. (5 marks) Comment on the following statement The reinsurance treaty that uses the underwriting year accounting method will involve premium portfolio and loss portfolio transfer at the expiration of treaty, and will effectively limit the reinsurer's responsibility for loss within the reinsurance treaty period. Question 3. (10 marks) ABC insurance company has a quota share treaty reinsurance with the XYZ reinsurance company to cover its homeowners' insurance. The original risk that is covered by the quota share treaty is subject to catastrophic losses related to hurricane. 3.1 Explain whether the quota share treaty reinsurance can handle the catastrophic loss. (2 marks) 3.2 Describe a reinsurance strategy that can protect ABC insurance company and XYZ reinsurance company against the catastrophic loss. (6 marks) 3.3 Explain how will a soft reinsurance market your proposed reinsurance strategy for ABC insurance company. (2 marks) Question 4. (5 marks) The 2018 California wildfires created huge losses to the insurance and reinsurance industry. One feature of those recent wildfires is the duration of the event. For instance, the Camp fire outbreak began on November 8th and full containment was only achieved on November 25th. The Woolsey wildfire outbreak began on November 8th as well and was contained on November 215 Which reinsurance contract clause could be affected by this kind of occurrence? (2 marks) What would be the potential impacts to the reinsurers? (3 marks) Question 5. (10 marks) Assume ABC insurance company is a life insurer based in Hong Kong. The outbreak of COVID -19 can cause catastrophic losses to ABC insurance company because of the suddenly increased death toll and medical bills. Looking into the future, ABC insurance company would like to use a catastrophe bond (CAT bond) to protect itself against the sudden jump in mortality rate due to the future outbreak of COVID -19. 5.1 Describe the structure of the above-mentioned CAT bond transaction (6 marks). 5.2 What does ABC insurance company need to pay attention to the CAT bond transaction in order to comply with the Hong Kong reinsurance regulation? (4 marks) Question 6. (15 marks) ABC insurance company has a 40% quota share treaty reinsurance with XYZ reinsurance company incepts 1 January 2019 with a treaty coverage period of 12 months. The premium ceded to this reinsurance treaty are as follows. Inception Date of Premium payable of Original Policy original risk to reinsurer 14 May 120,000 2 September 60,000 10 December 150,000 6.1 This reinsurance treaty is accounted on a clean-cut basis using the twenty fourth-basis method. Calculate the outgoing premium for this account at the expiration of the treaty period. (5 marks) 6.2 This treaty specifies that XYZ reinsurance company will pay a 30% commission based on the incoming premium and a 10% profit commission. Explain the rationales for XYZ insurance company to pay the reinsurance commissions to ABC insurance company. (5 marks) 6.3 In this treaty, ABC insurance company would keep 50% of the losses between a 75% and 85% loss ratio. If the actual loss ratio is 80%, what would be the ceded loss ratio under this treaty? (5 marks) Question 7. (25 marks) XYZ reinsurance company writes an excess of loss reinsurance for ABC insurance company. This treaty provides a cover of $400,000 over $200,000. XYZ reinsurance company tries to determine reinsurance premium using the burning cost method. The information regarding the past claims to the cover is provided in the following table. Year 2014 2015 2016 2017 2018 Claims to the cover 320,000 380,000 590,000 190,000 400,000 Premiums 8,700,000 9,000,000 12,000,000 12,500,000 13,000,000 7.1 Calculate the commercial rate for XYZ reinsurance company. Assume that XYZ insurance company decides to calculate the commercial rate with a loading factor of 100/80th. Show all your work. (10 marks) 7.2 In 2019, XYZ reinsurance company specifies that the cover is provided with one reinstatement. The reinstate premium is charged on a pro-rata capita basis, i.e., payable at 30% of the reinsurance premium charged for the cover. Assume that there are two original claims (400,000 and 300,000) that are submitted to the cover in 2019. At the beginning of 2019, the original premium to the cover is estimated at 10,000,000. Calculate the total amount of reinsurance premium for this treaty in 2019. (15 marks) Question 8. (15 marks) ABC insurance company has the following reinsurance program. A surplus share treaty with a line of 2 million with 6-line maximum. The gross retention of surplus share treaty is covered by a facultive excess of loss reinsurance with three layers: (1) 0.5 million excess of 0.5 million; (2) 0.5 million excess of 1 million; (3) 0.5 million excess of 1.5 million. Assume ABC insurance company use the above reinsurance treaty to cover the fire insurance of building that worths 12 million dollars. During the treaty period, a valid claim of 9 million occurred. 8.1. What is the total compacity of the surplus treaty? (4 marks) 8.2 What is the share of loss for the reinsurer covering the layer of 0.5 million excess of 1 million? (5 marks) 8.3 What are the advantages that ABC insurance company using three layers of excess of loss reinsurance to limit its net retention instead of using one excess of loss reinsurance? (6 marks) Question 9. (5 marks) In July 2018, the China Banking and Insurance Regulatory Commission (CBIRC) agreed to give preferential treatment to Hong Kong-based reinsurers. Briefly explain what this preferential treatment is and what would be the potential impact of this regulatory policy change to the Hong Kong government's initiative to develop the insurance and reinsurance industry in Hong Kong. Question 1. (10 marks) ABC insurance company is using a quota share treaty reinsurance to transfer some of the risks to its reinsurer, XYZ reinsurance company, for the current year. Some of these risks in ABC insurance company's portfolio are very significant in terms of the sum insured and potential for major losses due to natural catastrophe. XYZ reinsurance company excludes those risks from the treaty reinsurance. 1.1 Describe two alternatives of risk transfer that may be used by ABC insurance company other than treaty reinsurance. (6 marks) 1.2 Describe the impact of using quota share treaty reinsurance on ABC insurance company's income statement. (4 marks) Question 2. (5 marks) Comment on the following statement The reinsurance treaty that uses the underwriting year accounting method will involve premium portfolio and loss portfolio transfer at the expiration of treaty, and will effectively limit the reinsurer's responsibility for loss within the reinsurance treaty period. Question 3. (10 marks) ABC insurance company has a quota share treaty reinsurance with the XYZ reinsurance company to cover its homeowners' insurance. The original risk that is covered by the quota share treaty is subject to catastrophic losses related to hurricane. 3.1 Explain whether the quota share treaty reinsurance can handle the catastrophic loss. (2 marks) 3.2 Describe a reinsurance strategy that can protect ABC insurance company and XYZ reinsurance company against the catastrophic loss. (6 marks) 3.3 Explain how will a soft reinsurance market your proposed reinsurance strategy for ABC insurance company. (2 marks) Question 4. (5 marks) The 2018 California wildfires created huge losses to the insurance and reinsurance industry. One feature of those recent wildfires is the duration of the event. For instance, the Camp fire outbreak began on November 8th and full containment was only achieved on November 25th. The Woolsey wildfire outbreak began on November 8th as well and was contained on November 215 Which reinsurance contract clause could be affected by this kind of occurrence? (2 marks) What would be the potential impacts to the reinsurers? (3 marks) Question 5. (10 marks) Assume ABC insurance company is a life insurer based in Hong Kong. The outbreak of COVID -19 can cause catastrophic losses to ABC insurance company because of the suddenly increased death toll and medical bills. Looking into the future, ABC insurance company would like to use a catastrophe bond (CAT bond) to protect itself against the sudden jump in mortality rate due to the future outbreak of COVID -19. 5.1 Describe the structure of the above-mentioned CAT bond transaction (6 marks). 5.2 What does ABC insurance company need to pay attention to the CAT bond transaction in order to comply with the Hong Kong reinsurance regulation? (4 marks) Question 6. (15 marks) ABC insurance company has a 40% quota share treaty reinsurance with XYZ reinsurance company incepts 1 January 2019 with a treaty coverage period of 12 months. The premium ceded to this reinsurance treaty are as follows. Inception Date of Premium payable of Original Policy original risk to reinsurer 14 May 120,000 2 September 60,000 10 December 150,000 6.1 This reinsurance treaty is accounted on a clean-cut basis using the twenty fourth-basis method. Calculate the outgoing premium for this account at the expiration of the treaty period. (5 marks) 6.2 This treaty specifies that XYZ reinsurance company will pay a 30% commission based on the incoming premium and a 10% profit commission. Explain the rationales for XYZ insurance company to pay the reinsurance commissions to ABC insurance company. (5 marks) 6.3 In this treaty, ABC insurance company would keep 50% of the losses between a 75% and 85% loss ratio. If the actual loss ratio is 80%, what would be the ceded loss ratio under this treaty? (5 marks) Question 7. (25 marks) XYZ reinsurance company writes an excess of loss reinsurance for ABC insurance company. This treaty provides a cover of $400,000 over $200,000. XYZ reinsurance company tries to determine reinsurance premium using the burning cost method. The information regarding the past claims to the cover is provided in the following table. Year 2014 2015 2016 2017 2018 Claims to the cover 320,000 380,000 590,000 190,000 400,000 Premiums 8,700,000 9,000,000 12,000,000 12,500,000 13,000,000 7.1 Calculate the commercial rate for XYZ reinsurance company. Assume that XYZ insurance company decides to calculate the commercial rate with a loading factor of 100/80th. Show all your work. (10 marks) 7.2 In 2019, XYZ reinsurance company specifies that the cover is provided with one reinstatement. The reinstate premium is charged on a pro-rata capita basis, i.e., payable at 30% of the reinsurance premium charged for the cover. Assume that there are two original claims (400,000 and 300,000) that are submitted to the cover in 2019. At the beginning of 2019, the original premium to the cover is estimated at 10,000,000. Calculate the total amount of reinsurance premium for this treaty in 2019. (15 marks) Question 8. (15 marks) ABC insurance company has the following reinsurance program. A surplus share treaty with a line of 2 million with 6-line maximum. The gross retention of surplus share treaty is covered by a facultive excess of loss reinsurance with three layers: (1) 0.5 million excess of 0.5 million; (2) 0.5 million excess of 1 million; (3) 0.5 million excess of 1.5 million. Assume ABC insurance company use the above reinsurance treaty to cover the fire insurance of building that worths 12 million dollars. During the treaty period, a valid claim of 9 million occurred. 8.1. What is the total compacity of the surplus treaty? (4 marks) 8.2 What is the share of loss for the reinsurer covering the layer of 0.5 million excess of 1 million? (5 marks) 8.3 What are the advantages that ABC insurance company using three layers of excess of loss reinsurance to limit its net retention instead of using one excess of loss reinsurance? (6 marks) Question 9. (5 marks) In July 2018, the China Banking and Insurance Regulatory Commission (CBIRC) agreed to give preferential treatment to Hong Kong-based reinsurers. Briefly explain what this preferential treatment is and what would be the potential impact of this regulatory policy change to the Hong Kong government's initiative to develop the insurance and reinsurance industry in Hong Kong