Question: Question 1 - (10 marks) This question tells a sad tale of Merrill Lynched, an investment bank. Investment banks have a higher maximum asset to

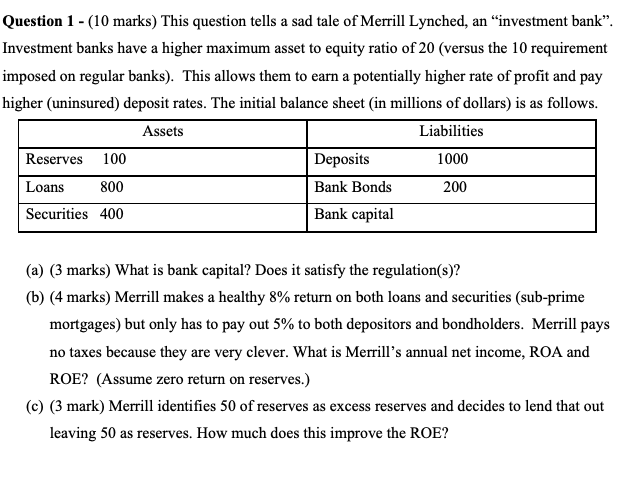

Question 1 - (10 marks) This question tells a sad tale of Merrill Lynched, an investment bank. Investment banks have a higher maximum asset to equity ratio of 20 (versus the 10 requirement imposed on regular banks). This allows them to earn a potentially higher rate of profit and pay higher (uninsured) deposit rates. The initial balance sheet (in millions of dollars) is as follows. Assets Liabilities Reserves 100 Deposits 1000 Loans 800 Bank Bonds 200 Securities 400 Bank capital (a) (3 marks) What is bank capital? Does it satisfy the regulation(s)? (b) (4 marks) Merrill makes a healthy 8% return on both loans and securities (sub-prime mortgages) but only has to pay out 5% to both depositors and bondholders. Merrill pays no taxes because they are very clever. What is Merrill's annual net income, ROA and ROE? (Assume zero return on reserves.) (c) (3 mark) Merrill identifies 50 of reserves as excess reserves and decides to lend that out leaving 50 as reserves. How much does this improve the ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts