Question: Question 1 [10 marks) You are given the following information regarding the prices per share for company XYZ: January 1, 2019 January 1, 2020 Bid

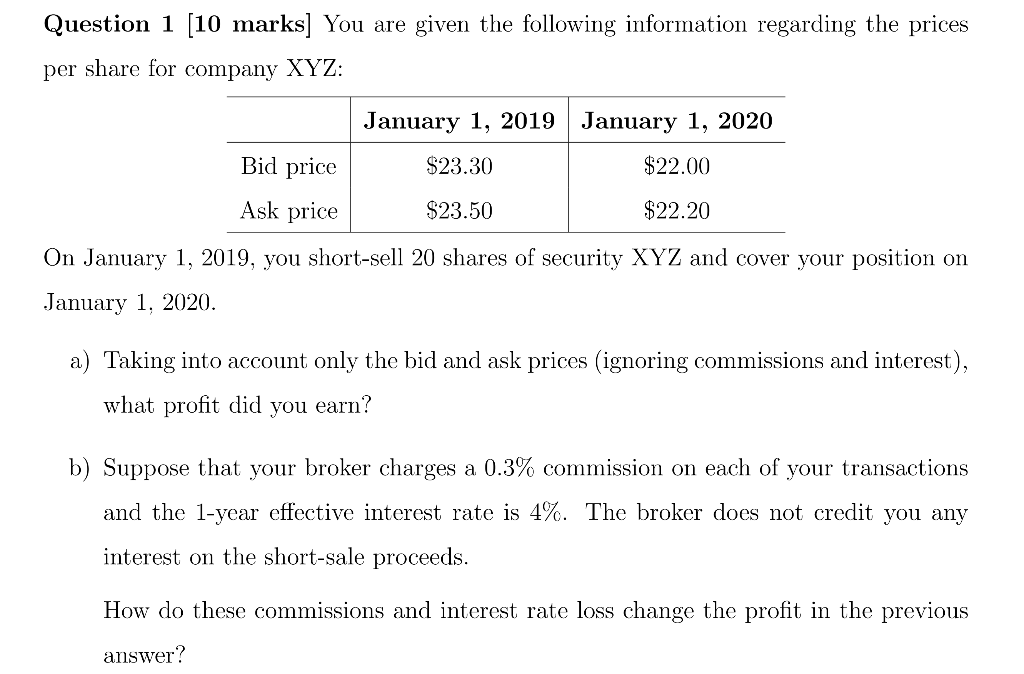

Question 1 [10 marks) You are given the following information regarding the prices per share for company XYZ: January 1, 2019 January 1, 2020 Bid price $23.30 $22.00 Ask price $23.50 $22.20 On January 1, 2019, you short-sell 20 shares of security XYZ and cover your position on January 1, 2020. a) Taking into account only the bid and ask prices (ignoring commissions and interest), what profit did you earn? b) Suppose that your broker charges a 0.3% commission on each of your transactions and the 1-year effective interest rate is 4%. The broker does not credit you any interest on the short-sale proceeds. How do these commissions and interest rate loss change the profit in the previous answer? Question 1 [10 marks) You are given the following information regarding the prices per share for company XYZ: January 1, 2019 January 1, 2020 Bid price $23.30 $22.00 Ask price $23.50 $22.20 On January 1, 2019, you short-sell 20 shares of security XYZ and cover your position on January 1, 2020. a) Taking into account only the bid and ask prices (ignoring commissions and interest), what profit did you earn? b) Suppose that your broker charges a 0.3% commission on each of your transactions and the 1-year effective interest rate is 4%. The broker does not credit you any interest on the short-sale proceeds. How do these commissions and interest rate loss change the profit in the previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts