Question: A forward rate agreement (FRA) exchanges a fixed 4.5% interest (quarterly compounded) for 3 months starting in 0.5 years on a principal of $200

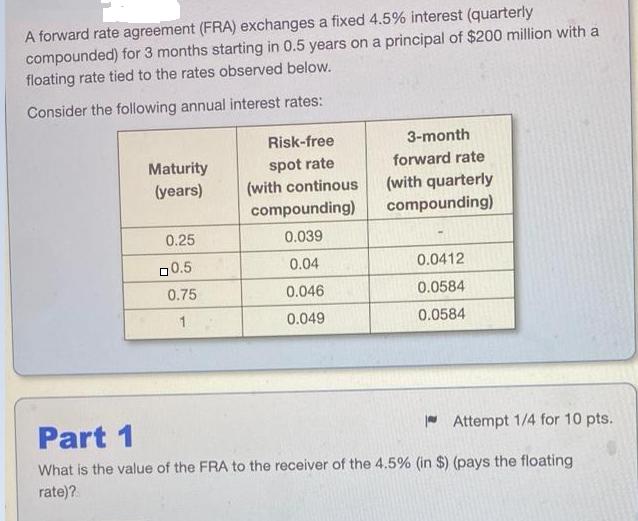

A forward rate agreement (FRA) exchanges a fixed 4.5% interest (quarterly compounded) for 3 months starting in 0.5 years on a principal of $200 million with a floating rate tied to the rates observed below. Consider the following annual interest rates: Maturity (years) 0.25 0.5 0.75 1 Risk-free spot rate (with continous compounding) 0.039 0.04 0.046 0.049 3-month forward rate (with quarterly compounding) 0.0412 0.0584 0.0584 Attempt 1/4 for 10 pts. Part 1 What is the value of the FRA to the receiver of the 4.5% (in $) (pays the floating rate)?

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts