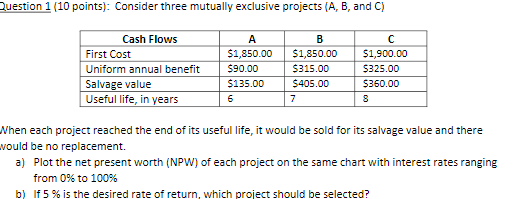

Question: Question 1 (10 points): Consider three mutually exclusive projects (A, B, and C) Cash Flows A C $1,850.00 $1,850.00 First Cost $1,900.00 $90.00 $315.00 Uniform

Question 1 (10 points): Consider three mutually exclusive projects (A, B, and C) Cash Flows A C $1,850.00 $1,850.00 First Cost $1,900.00 $90.00 $315.00 Uniform annual benefit S325.00 $135.00 $405.00 Salvage value Useful life, in years S360.00 6 7 8 When each project reached the end of its useful life, it would be sold for its salvage value and there vould be no replacement. a) Plot the net present worth (NPW) of each project on the same chart with interest rates ranging from 0% to 100 % b) If 5% is the desired rate of return, which proiect should be selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts