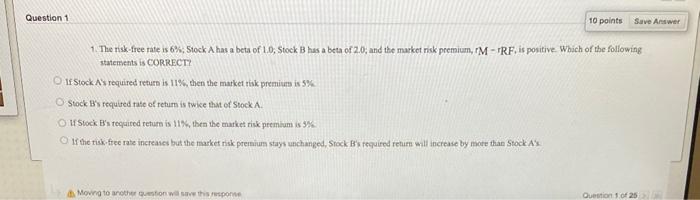

Question: Question 1 10 points Save Answer 1. The risk-free rate is 6%, Stock A has a beta of 1.0, Stock Bhas a beta of 2.0;

Question 1 10 points Save Answer 1. The risk-free rate is 6%, Stock A has a beta of 1.0, Stock Bhas a beta of 2.0; and the market risk premium, PM - TRF, is positive. Which of the following statements is CORRECT If Stock Ass required return is 11%, then the market risk premium is 5% Shock B'y required rate of retum is twice that of Stock Out Stock B's required return is 11%, then the market rink premium is 3% If the risk tree rare increases but the market risk premium stays unchanged, Stock B's required return will increase by more than Stock AS Moving to the question with uspon Question of 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts