Question: QUESTION 1 10 points Save Answer A firm is considering a project and plan to obtain a target capital structure with $85,303 of debt at

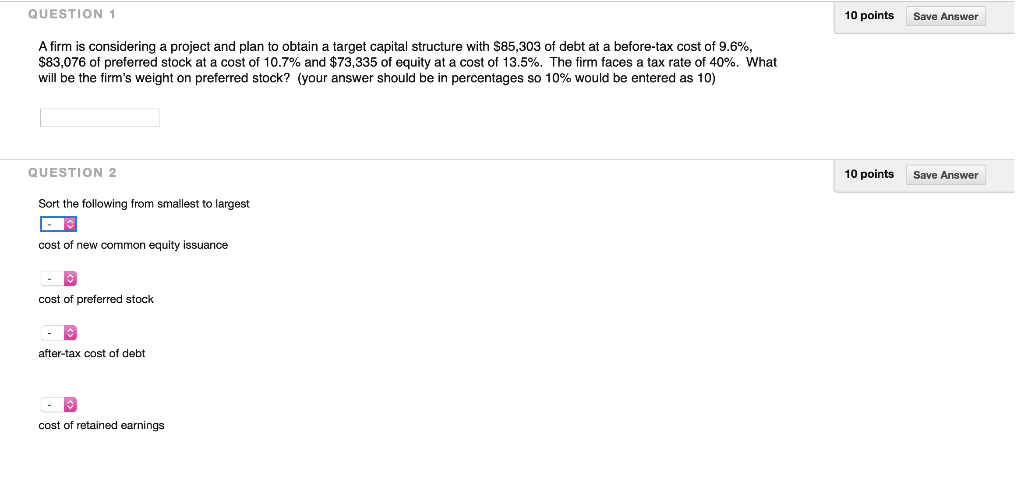

QUESTION 1 10 points Save Answer A firm is considering a project and plan to obtain a target capital structure with $85,303 of debt at a before-tax cost of 9.6%, $83,076 of preferred stock at a cost of 10.7% and $73,335 of equity at a cost of 13.5%. The firm faces a tax rate of 40%. What will be the firm's weight on preferred stock? (your answer should be in percentages so 10% would be entered as 10) QUESTION 2 10 points Save Answer Sort the following from smallest to largest - cost of new common equity issuance cost of preferred stock after-tax cost of debt cost of retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts