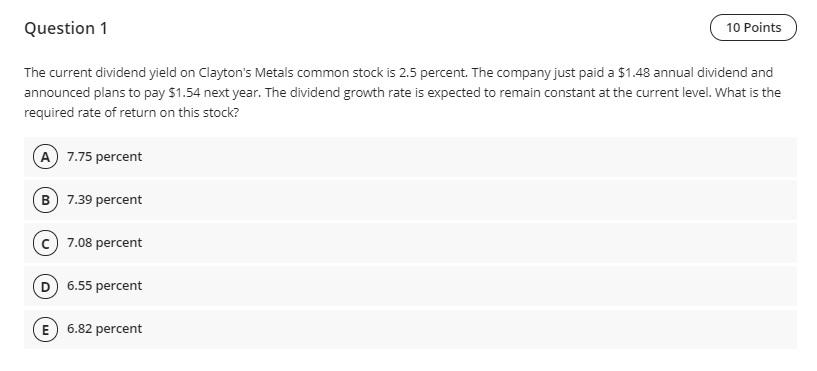

Question: Question 1 10 Points The current dividend yield on Clayton's Metals common stock is 2.5 percent. The company just paid a $1.48 annual dividend and

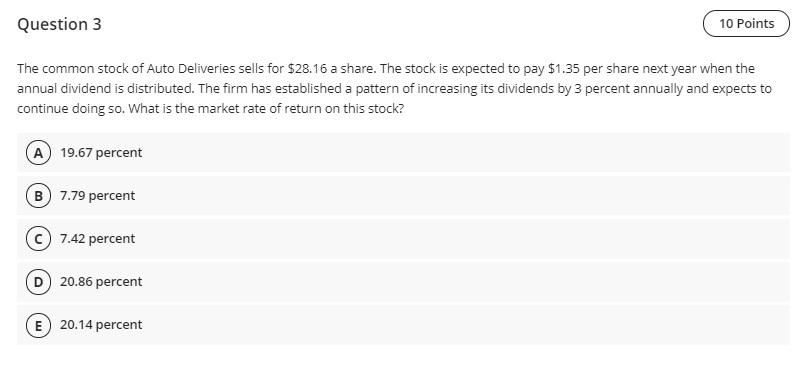

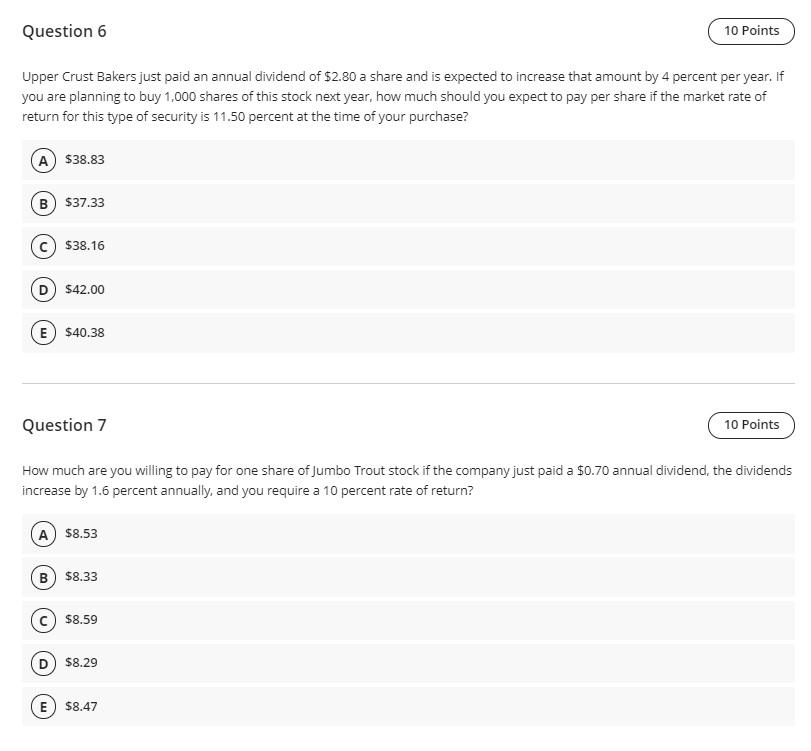

Question 1 10 Points The current dividend yield on Clayton's Metals common stock is 2.5 percent. The company just paid a $1.48 annual dividend and announced plans to pay 51.54 next year. The dividend growth rate is expected to remain constant at the current level. What is the required rate of return on this stock? A 7.75 percent B) 7.39 percent 7.08 percent D 6.55 percent E 6.82 percent Question 3 10 Points The common stock of Auto Deliveries sells for $28.16 a share. The stock is expected to pay $1.35 per share next year when the annual dividend is distributed. The firm has established a pattern of increasing its dividends by 3 percent annually and expects to continue doing so. What is the market rate of return on this stock? A 19.67 percent B) 7.79 percent 7.42 percent D 20.86 percent E) 20.14 percent Question 6 10 Points Upper Crust Bakers just paid an annual dividend of $2.80 a share and is expected to increase that amount by 4 percent per year. If you are planning to buy 1,000 shares of this stock next year, how much should you expect to pay per share if the market rate of return for this type of security is 11.50 percent at the time of your purchase? A $38.83 B) $37.33 $38.16 D) $42.00 E) $40.38 Question 7 10 Points How much are you willing to pay for one share of Jumbo Trout stock if the company just paid a $0.70 annual dividend, the dividends increase by 1.6 percent annually, and you require a 10 percent rate of return? A) $8.53 B $8.33 $8.59 $8.29 E $8.47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts