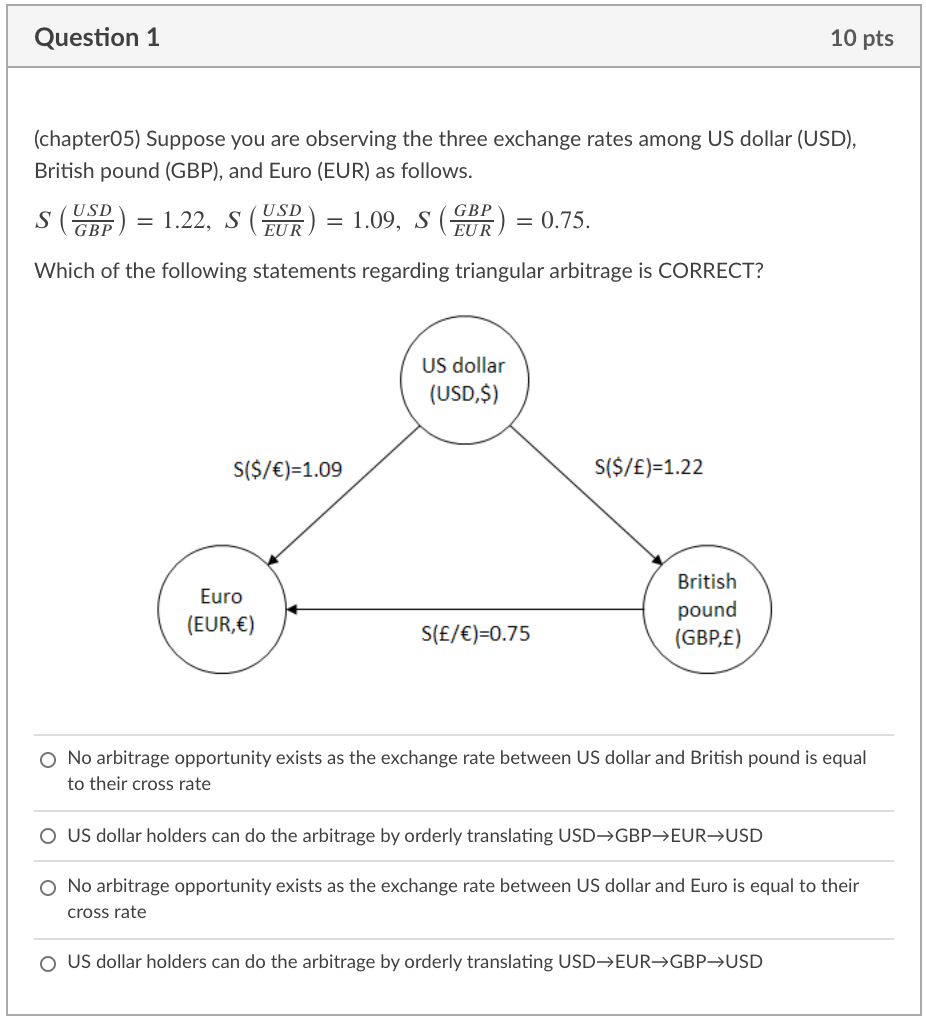

Question: Question 1 10 pts (chapter05) Suppose you are observing the three exchange rates among US dollar (USD), British pound (GBP), and Euro (EUR) as follows.

Question 1 10 pts (chapter05) Suppose you are observing the three exchange rates among US dollar (USD), British pound (GBP), and Euro (EUR) as follows. S USD GBP = 1.22, S (FSR) = 1.09, S (GBR) = 0.75. Which of the following statements regarding triangular arbitrage is CORRECT? US dollar (USD $) S($/ )=1.09 S($/)=1.22 British Euro (EUR,) S(/ )=0.75 pound (GBP,) No arbitrage opportunity exists as the exchange rate between US dollar and British pound is equal to their cross rate O US dollar holders can do the arbitrage by orderly translating USD=GBPEURUSD No arbitrage opportunity exists as the exchange rate between US dollar and Euro is equal to their cross rate O US dollar holders can do the arbitrage by orderly translating USD+EURGBPUSD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts