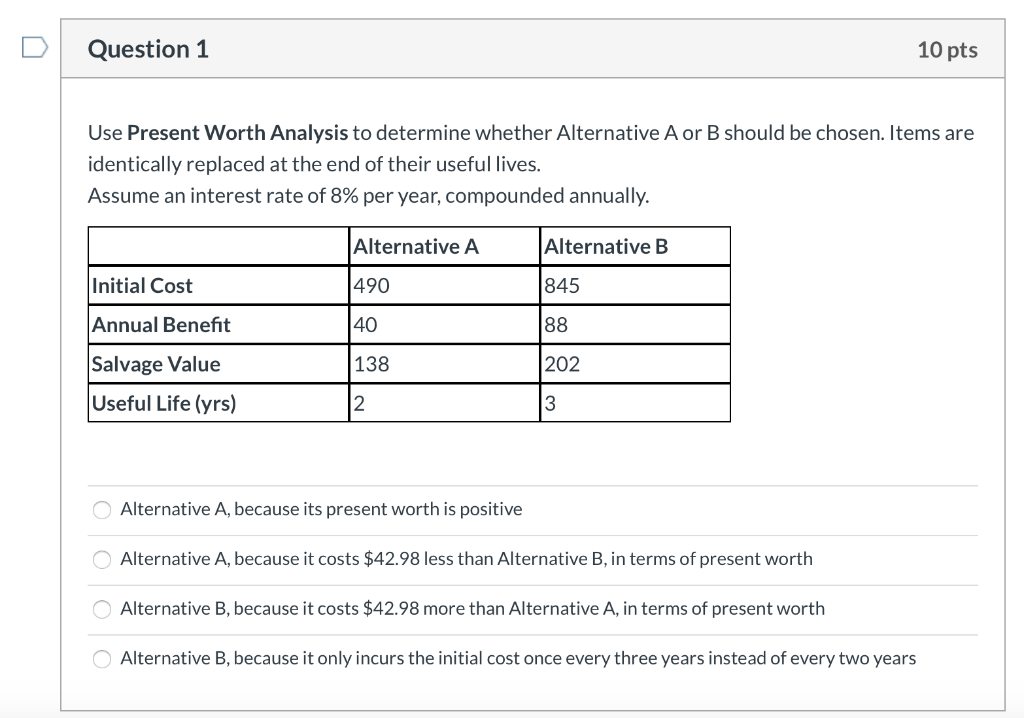

Question: Question 1 10 pts Use Present Worth Analysis to determine whether Alternative A or B should be chosen. Items are identically replaced at the end

Question 1 10 pts Use Present Worth Analysis to determine whether Alternative A or B should be chosen. Items are identically replaced at the end of their useful lives. Assume an interest rate of 8% per year, compounded annually. Alternative B Alternative A 490 845 40 88 Initial Cost Annual Benefit Salvage Value Useful Life (yrs) 138 202 Alternative A, because its present worth is positive Alternative A, because it costs $42.98 less than Alternative B, in terms of present worth Alternative B, because it costs $42.98 more than Alternative A, in terms of present worth O Alternative B, because it only incurs the initial cost once every three years instead of every two years Question 1 10 pts Use Present Worth Analysis to determine whether Alternative A or B should be chosen. Items are identically replaced at the end of their useful lives. Assume an interest rate of 8% per year, compounded annually. Alternative B Alternative A 490 845 40 88 Initial Cost Annual Benefit Salvage Value Useful Life (yrs) 138 202 Alternative A, because its present worth is positive Alternative A, because it costs $42.98 less than Alternative B, in terms of present worth Alternative B, because it costs $42.98 more than Alternative A, in terms of present worth O Alternative B, because it only incurs the initial cost once every three years instead of every two years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts