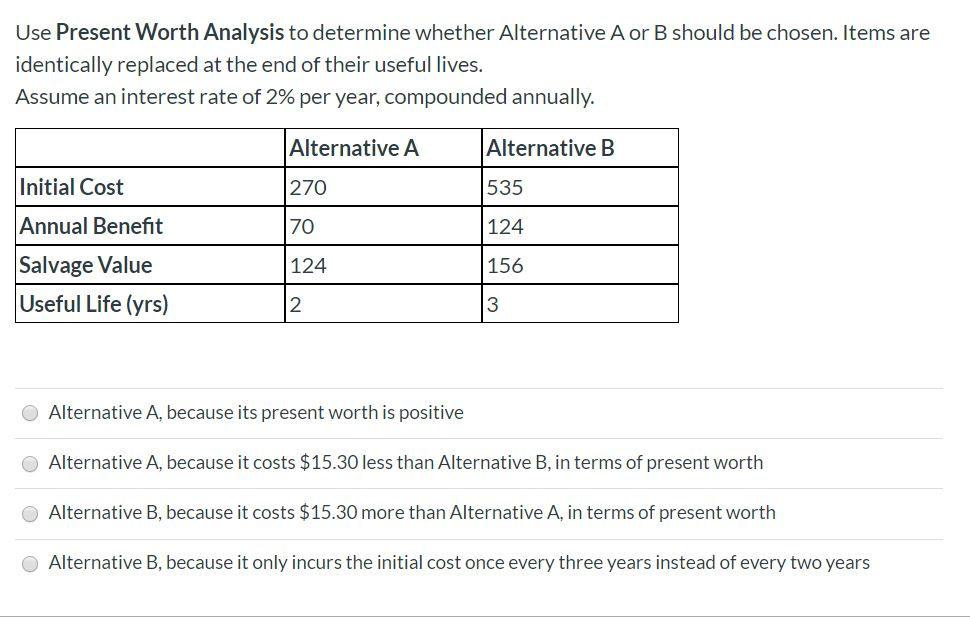

Question: Use Present Worth Analysis to determine whether Alternative A or B should be chosen. Items are identically replaced at the end of their useful lives.

Use Present Worth Analysis to determine whether Alternative A or B should be chosen. Items are identically replaced at the end of their useful lives. Assume an interest rate of 2% per year, compounded annually. Alternative B Alternative A 270 535 70 124 Initial Cost Annual Benefit Salvage Value Useful Life (yrs) 156 124 12 O Alternative A, because its present worth is positive Alternative A, because it costs $15.30 less than Alternative B, in terms of present worth Alternative B, because it costs $15.30 more than Alternative A, in terms of present worth Alternative B, because it only incurs the initial cost once every three years instead of every two years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts