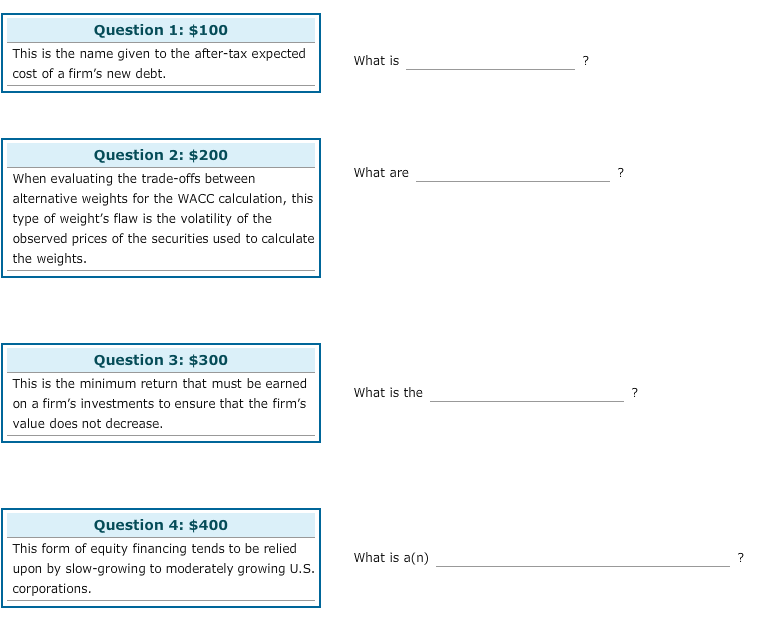

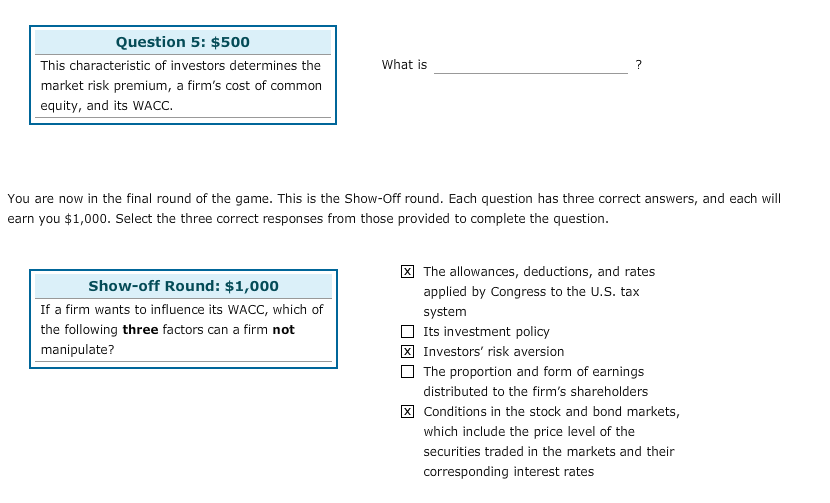

Question: Question 1: $100 This is the name given to the after-tax expected cost of a firm's new debt. Question 2: $200 When evaluating the trade-offs

Question 1: $100 This is the name given to the after-tax expected cost of a firm's new debt. Question 2: $200 When evaluating the trade-offs between alternative weights for the WACC calculation, this type of weight's flaw is the volatility of the observed prices of the securities used to calculate the weights. Question 3: $300 This is the minimum return that must be earned on a firm's investments to ensure that the firm's value does not decrease. Question 4: $400 This form of equity financing tends to be relied upon by slow-growing to moderately growing U.S. Corporations What is What are What is the what is (n) Question 1: $100 This is the name given to the after-tax expected cost of a firm's new debt. Question 2: $200 When evaluating the trade-offs between alternative weights for the WACC calculation, this type of weight's flaw is the volatility of the observed prices of the securities used to calculate the weights. Question 3: $300 This is the minimum return that must be earned on a firm's investments to ensure that the firm's value does not decrease. Question 4: $400 This form of equity financing tends to be relied upon by slow-growing to moderately growing U.S. Corporations What is What are What is the what is (n)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts