Question: Question 1 1/1 pts Question #1 and #2 use the following setup: You have just received a windfall from an investment project. It will be

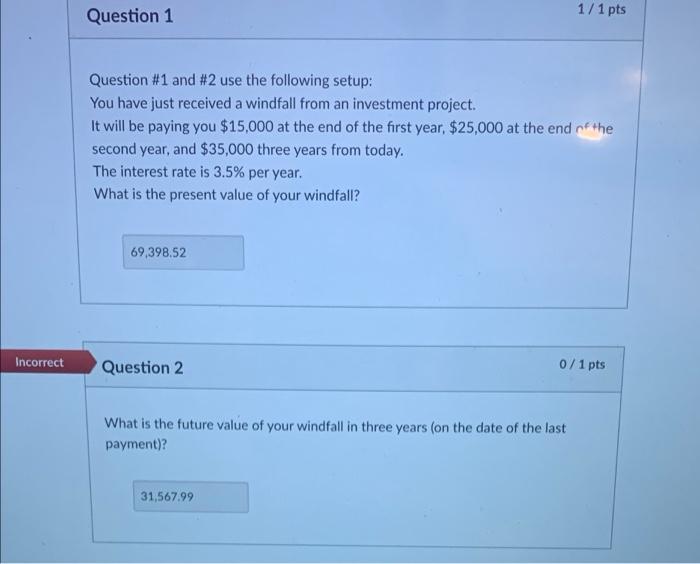

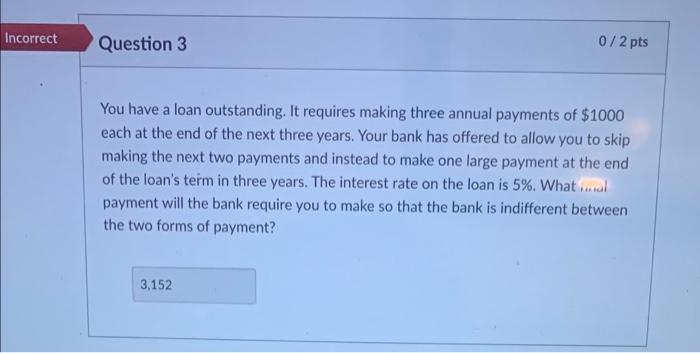

Question 1 1/1 pts Question #1 and #2 use the following setup: You have just received a windfall from an investment project. It will be paying you $15,000 at the end of the first year, $25,000 at the end of the second year, and $35,000 three years from today. The interest rate is 3.5% per year. What is the present value of your windfall? 69,398.52 Incorrect Question 2 0/1 pts What is the future value of your windfall in three years (on the date of the last payment)? 31,567.99 Incorrect Question 3 0/2 pts You have a loan outstanding. It requires making three annual payments of $1000 each at the end of the next three years. Your bank has offered to allow you to skip making the next two payments and instead to make one large payment at the end of the loan's term in three years. The interest rate on the loan is 5%. What ... payment will the bank require you to make so that the bank is indifferent between the two forms of payment? 3,152

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts