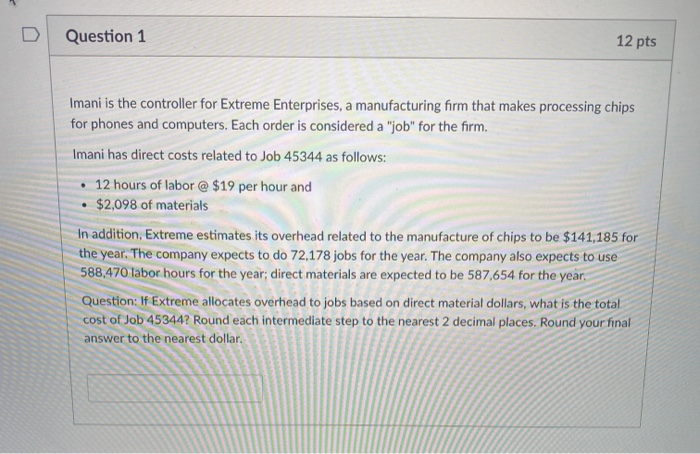

Question: Question 1 12 pts Imani is the controller for Extreme Enterprises, a manufacturing firm that makes processing chips for phones and computers. Each order is

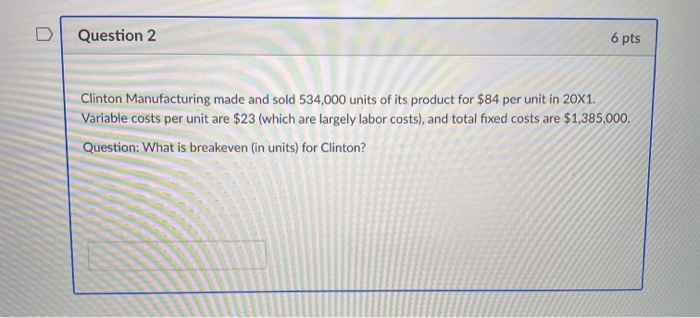

Question 1 12 pts Imani is the controller for Extreme Enterprises, a manufacturing firm that makes processing chips for phones and computers. Each order is considered a "job" for the firm. Imani has direct costs related to Job 45344 as follows: 12 hours of labor @ $19 per hour and $2,098 of materials In addition, Extreme estimates its overhead related to the manufacture of chips to be $141,185 for the year. The company expects to do 72,178 jobs for the year. The company also expects to use 588,470 labor hours for the year; direct materials are expected to be 587,654 for the year Question: If Extreme allocates overhead to jobs based on direct material dollars, what is the total cost of Job 45344? Round each intermediate step to the nearest 2 decimal places. Round your final answer to the nearest dollar. Question 2 6 pts Clinton Manufacturing made and sold 534,000 units of its product for $84 per unit in 20x1. Variable costs per unit are $23 (which are largely labor costs), and total fixed costs are $1,385,000. Question: What is breakeven (in units) for Clinton

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts