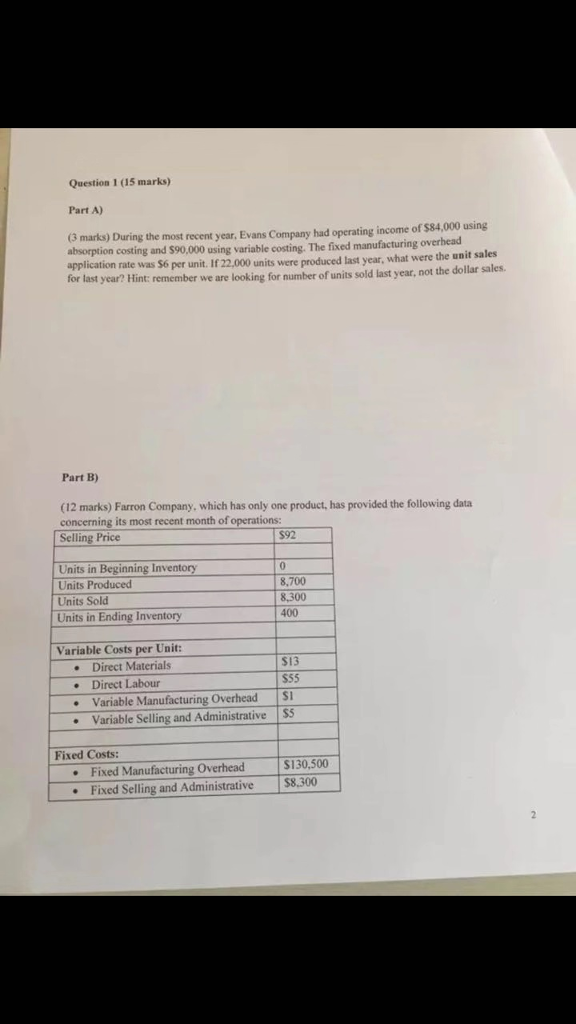

Question: Question 1 (15 marks) Part A) During the most recent year, Evans Company had operating income of $84,000 using costing and $90,000 using variable costing.

Question 1 (15 marks) Part A) During the most recent year, Evans Company had operating income of $84,000 using costing and $90,000 using variable costing. The fixed manufacturing overhead (3 marks) absorption application rate was $6 per unit. If 22,000 units were produced last year, what were the unit sales for last year? Hint: remember we are looking for number of units sold last year, not the dollar sales Part B) (12 marks) Farron Company, which has only one product, has provided the following data concerning its most recent month of operations: Selling Price $92 Units in Beginning Inventory Units Produced Units Sold Units in Ending Inventory 8,700 8,300 400 Variable Costs per Unit S13 S55 Direct Materials . Direct Labour . Variable Manufacturing Overhead SI Variable Selling and Administrative SS Fixed Costs: . Fixed Manufacturing Overhead .Fixed Selling and Administrative $8,300 S130,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts