Question: Question 1: (15 points) Dr. Anthony Smith is a young CFO of the Athena Bank who holds a Master of Science in Finance degree, with

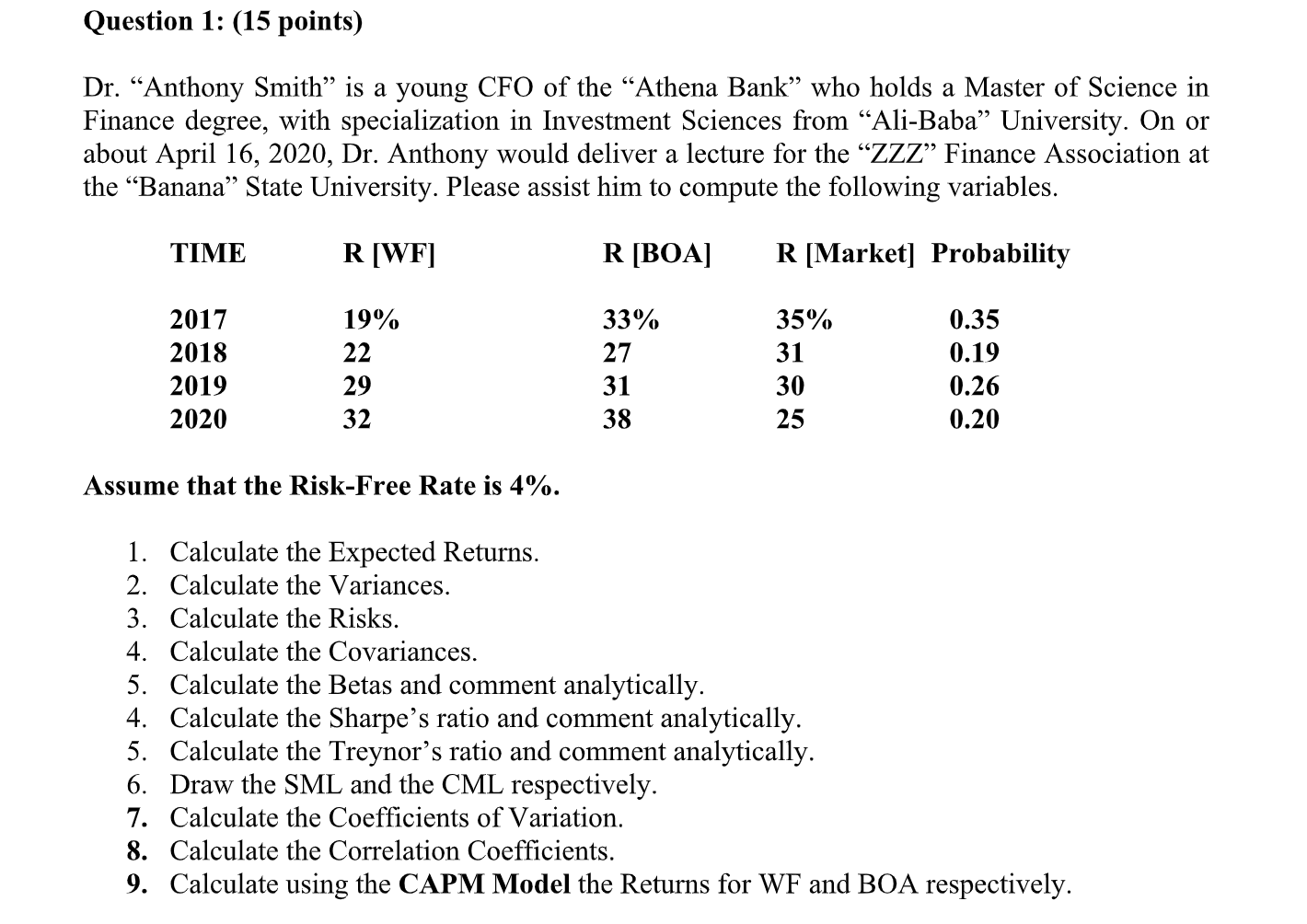

Question 1: (15 points) Dr. Anthony Smith is a young CFO of the Athena Bank who holds a Master of Science in Finance degree, with specialization in Investment Sciences from Ali-Baba University. On or about April 16, 2020, Dr. Anthony would deliver a lecture for the ZZZ Finance Association at the Banana State University. Please assist him to compute the following variables. TIME R[WF] R [BOA) R [Market] Probability 33% 19% 22 35% 31 27 2017 2018 2019 2020 0.35 0.19 0.26 0.20 29 31 30 38 25 Assume that the Risk-Free Rate is 4%. 1. Calculate the Expected Returns. 2. Calculate the Variances. 3. Calculate the Risks. 4. Calculate the Covariances 5. Calculate the Betas and comment analytically. 4. Calculate the Sharpe's ratio and comment analytically. 5. Calculate the Treynor's ratio and comment analytically. 6. Draw the SML and the CML respectively. 7. Calculate the Coefficients of Variation. 8. Calculate the Correlation Coefficients. 9. Calculate using the CAPM Model the Returns for WF and BOA respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts