Question: Question 1: 17.5 marks) Presented below is an income statement for Hussam Company for the year ended December 31, 2020. Hussam Company Income Statement For

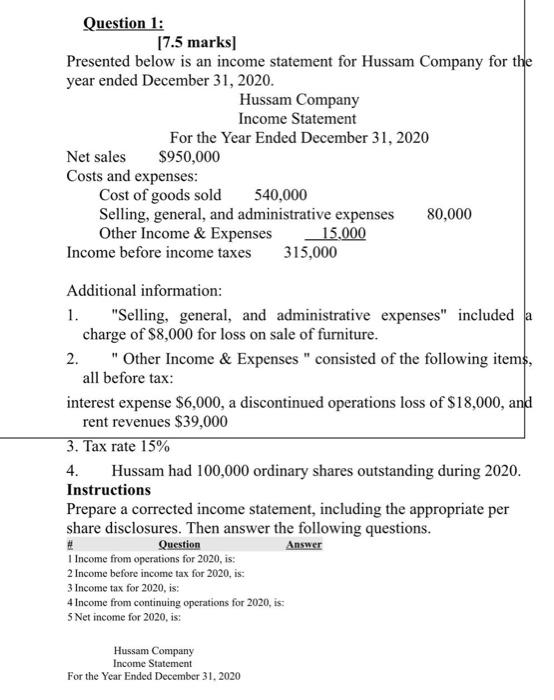

Question 1: 17.5 marks) Presented below is an income statement for Hussam Company for the year ended December 31, 2020. Hussam Company Income Statement For the Year Ended December 31, 2020 Net sales $950,000 Costs and expenses: Cost of goods sold 540,000 Selling, general, and administrative expenses 80,000 Other Income & Expenses 15.000 Income before income taxes 315,000 Additional information: 1. "Selling, general, and administrative expenses" included a charge of $8,000 for loss on sale of furniture. 2. " Other Income & Expenses " consisted of the following items, all before tax: interest expense $6,000, a discontinued operations loss of $18,000, and rent revenues $39,000 3. Tax rate 15% 4. Hussam had 100,000 ordinary shares outstanding during 2020. Instructions Prepare a corrected income statement, including the appropriate per share disclosures. Then answer the following questions. # Question Answer 1 Income from operations for 2020, is: 2 Income before income tax for 2020, is: 3 Income tax for 2020, is: 4 Income from continuing operations for 2020, is 5 Net income for 2020, is: Hussam Company Income Statement For the Year Ended December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts