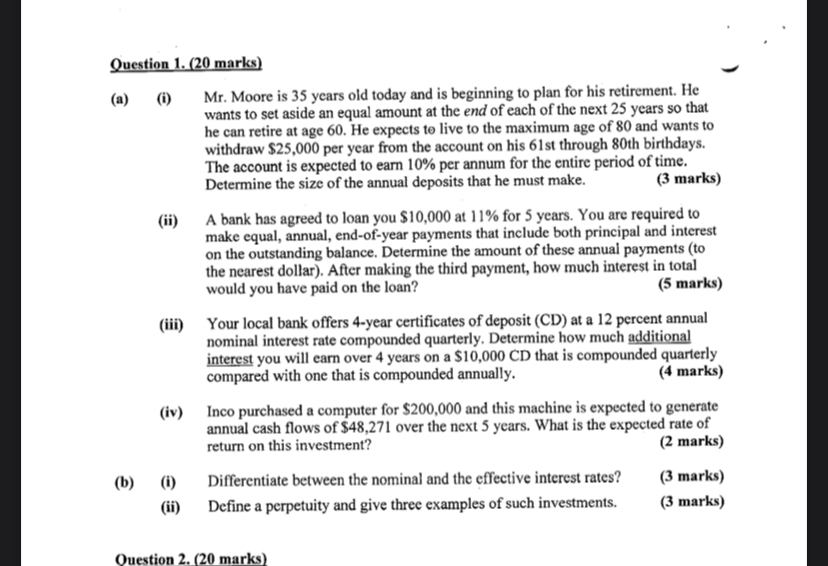

Question: Question 1 . ( 2 0 marks ) ( a ) ( i ) Mr . Moore is 3 5 years old today and is

Question marks

ai Mr Moore is years old today and is beginning to plan for his retirement. He

wants to set aside an equal amount at the end of each of the next years so that

he can retire at age He expects to live to the maximum age of and wants to

withdraw $ per year from the account on his st through th birthdays.

The account is expected to earn per annum for the entire period of time.

Determine the size of the annual deposits that he must make.

marks

ii A bank has agreed to loan you $ at for years. You are required to

make equal, annual, endofyear payments that include both principal and interest

on the outstanding balance. Determine the amount of these annual payments to

the nearest dollar After making the third payment, how much interest in total

would you have paid on the loan?

marks

iii Your local bank offers year certificates of deposit CD at a percent annual

nominal interest rate compounded quarterly. Determine how much additional

interest you will earn over years on a $ that is compounded quarterly

compared with one that is compounded annually.

marks

iv Inco purchased a computer for $ and this machine is expected to generate

annual cash flows of $ over the next years. What is the expected rate of

return on this investment?

marks

bi Differentiate between the nominal and the effective interest rates?

marks

ii Define a perpetuity and give three examples of such investments.

marks

Ouestion marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock