Question: Question 1 2 ( 1 point ) A historic study of financial markets ( 1 9 2 0 s - present ) demonatrates that: Stocks

Question point

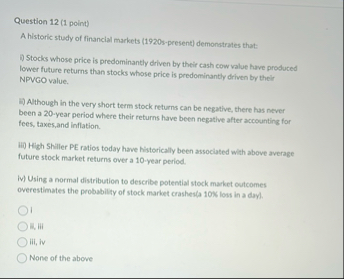

A historic study of financial markets spresent demonatrates that:

Stocks whose price is predominantly driven by their cash cow value have produced lower future returns than stocks whose price is predominantly driven by their NPVGO value.

Although in the very short term stock returns can be negative, there has never been a year period where their returns have been negative after accounting for fees, taxes, and inflation.

iii High Shiller PE ratios today have historically been associated with above average future stock market returns over a year period.

iv Using a normal distribution to describe polential stock market outcomes overestimates the probability of stock market crashesa loss in a dayl.

iii

iii, iv

None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock