Question: QUESTION 1: (2 points each section, a total of 4 points) You are the manager of All-Equity pension fund with a $400 million stock portfolio

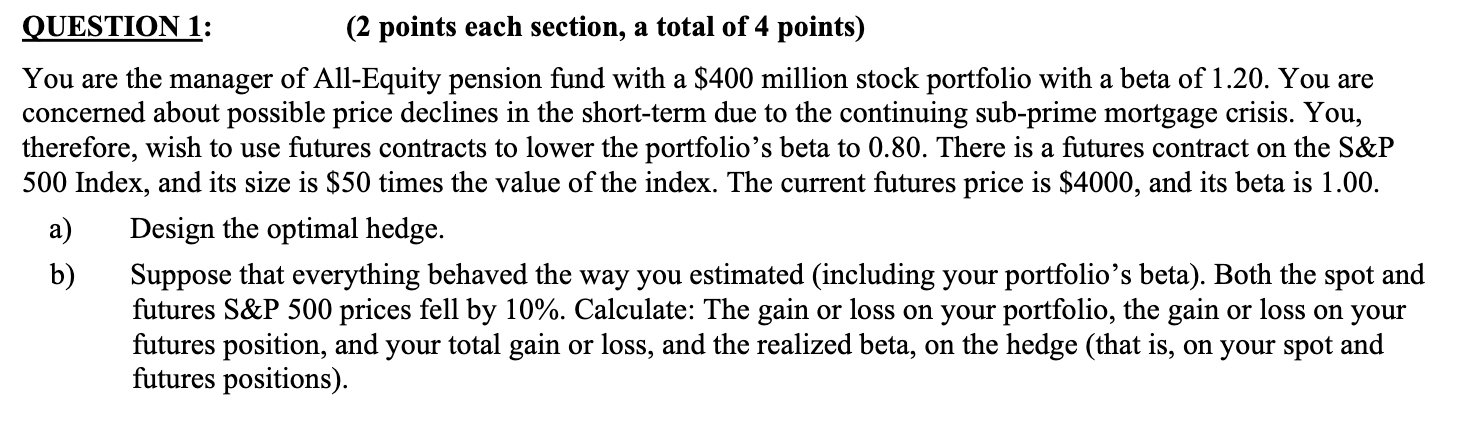

QUESTION 1: (2 points each section, a total of 4 points) You are the manager of All-Equity pension fund with a $400 million stock portfolio with a beta of 1.20. You are a concerned about possible price declines in the short-term due to the continuing sub-prime mortgage crisis. You, therefore, wish to use futures contracts to lower the portfolio's beta to 0.80. There is a futures contract on the S&P 500 Index, and its size is $50 times the value of the index. The current futures price is $4000, and its beta is 1.00. a) Design the optimal hedge. b) Suppose that everything behaved the way you estimated (including your portfolio's beta). Both the spot and futures S&P 500 prices fell by 10%. Calculate: The gain or loss on your portfolio, the gain or loss on your futures position, and your total gain or loss, and the realized beta, on the hedge (that is, on your spot and futures positions). QUESTION 1: (2 points each section, a total of 4 points) You are the manager of All-Equity pension fund with a $400 million stock portfolio with a beta of 1.20. You are a concerned about possible price declines in the short-term due to the continuing sub-prime mortgage crisis. You, therefore, wish to use futures contracts to lower the portfolio's beta to 0.80. There is a futures contract on the S&P 500 Index, and its size is $50 times the value of the index. The current futures price is $4000, and its beta is 1.00. a) Design the optimal hedge. b) Suppose that everything behaved the way you estimated (including your portfolio's beta). Both the spot and futures S&P 500 prices fell by 10%. Calculate: The gain or loss on your portfolio, the gain or loss on your futures position, and your total gain or loss, and the realized beta, on the hedge (that is, on your spot and futures positions)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts