Question: QUESTION 2: (2 points each section, a total of 4 points) You are the manager of a pension fund that is index to the S&P

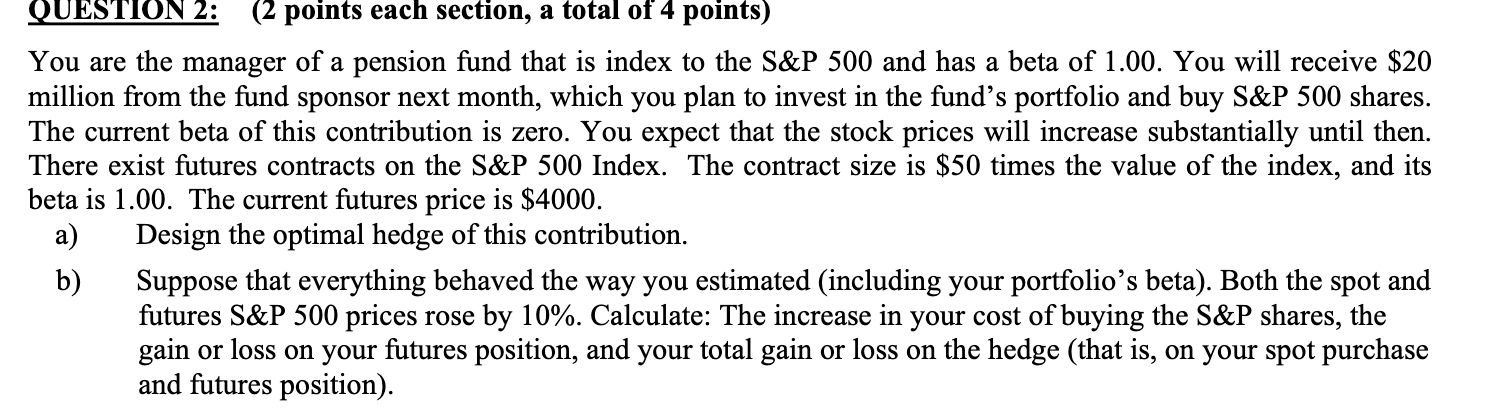

QUESTION 2: (2 points each section, a total of 4 points) You are the manager of a pension fund that is index to the S&P 500 and has a beta of 1.00. You will receive $20 million from the fund sponsor next month, which you plan to invest in the fund's portfolio and buy S&P 500 shares. The current beta of this contribution is zero. You expect that the stock prices will increase substantially until then. There exist futures contracts on the S&P 500 Index. The contract size is $50 times the value of the index, and its beta is 1.00. The current futures price is $4000. a) Design the optimal hedge of this contribution. b) Suppose that everything behaved the way you estimated (including your portfolio's beta). Both the spot and futures S&P 500 prices rose by 10%. Calculate: The increase in your cost of buying the S&P shares, the gain or loss on your futures position, and your total gain or loss on the hedge (that is, on your spot purchase and futures position). QUESTION 2: (2 points each section, a total of 4 points) You are the manager of a pension fund that is index to the S&P 500 and has a beta of 1.00. You will receive $20 million from the fund sponsor next month, which you plan to invest in the fund's portfolio and buy S&P 500 shares. The current beta of this contribution is zero. You expect that the stock prices will increase substantially until then. There exist futures contracts on the S&P 500 Index. The contract size is $50 times the value of the index, and its beta is 1.00. The current futures price is $4000. a) Design the optimal hedge of this contribution. b) Suppose that everything behaved the way you estimated (including your portfolio's beta). Both the spot and futures S&P 500 prices rose by 10%. Calculate: The increase in your cost of buying the S&P shares, the gain or loss on your futures position, and your total gain or loss on the hedge (that is, on your spot purchase and futures position)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts