Question: Question 1 2 points SEC, a Semiconductor ( fabrication ) Equipment Company, has a central spare parts warehouse to support its chip fabrication plant customers

Question

points

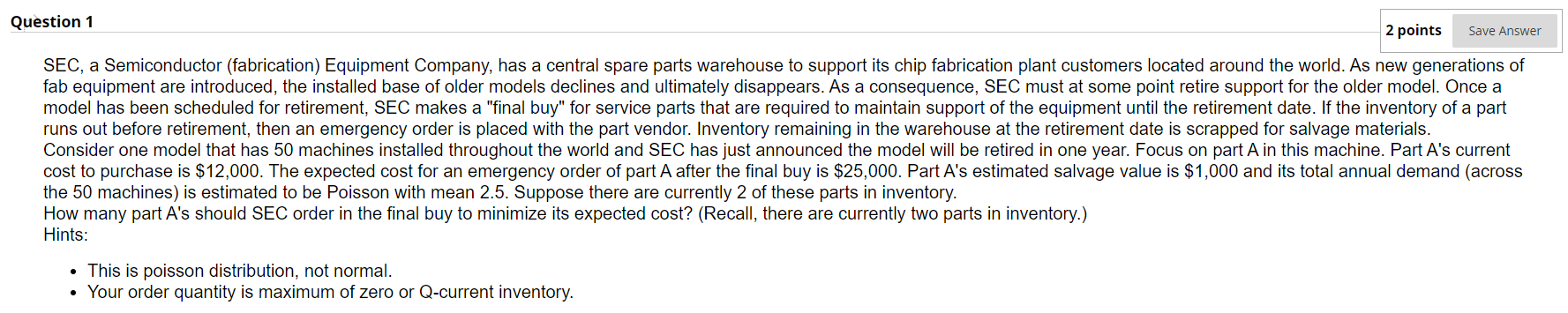

SEC, a Semiconductor fabrication Equipment Company, has a central spare parts warehouse to support its chip fabrication plant customers located around the world. As new generations of

fab equipment are introduced, the installed base of older models declines and ultimately disappears. As a consequence, SEC must at some point retire support for the older model. Once a

model has been scheduled for retirement, SEC makes a "final buy" for service parts that are required to maintain support of the equipment until the retirement date. If the inventory of a part

runs out before retirement, then an emergency order is placed with the part vendor. Inventory remaining in the warehouse at the retirement date is scrapped for salvage materials.

Consider one model that has machines installed throughout the world and SEC has just announced the model will be retired in one year. Focus on part A in this machine. Part As current

cost to purchase is $ The expected cost for an emergency order of part A after the final buy is $ Part As estimated salvage value is $ and its total annual demand across

the machines is estimated to be Poisson with mean Suppose there are currently of these parts in inventory.

How many part As should SEC order in the final buy to minimize its expected cost? Recall there are currently two parts in inventory.

Hints:

This is poisson distribution, not normal.

Your order quantity is maximum of zero or Qcurrent inventory.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock