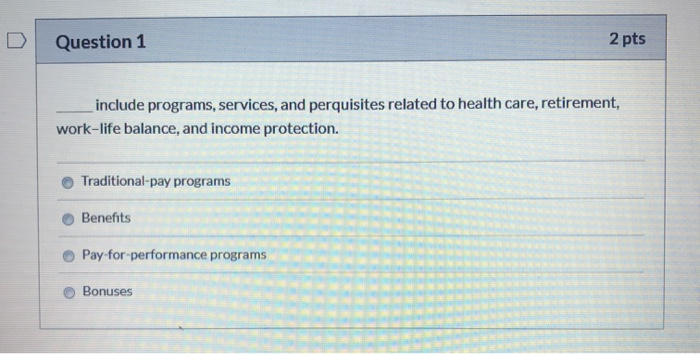

Question: Question 1 2 pts include programs, services, and perquisites related to health care, retirement, work-life balance, and income protection. Traditional-pay programs Benefits Pay for performance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock