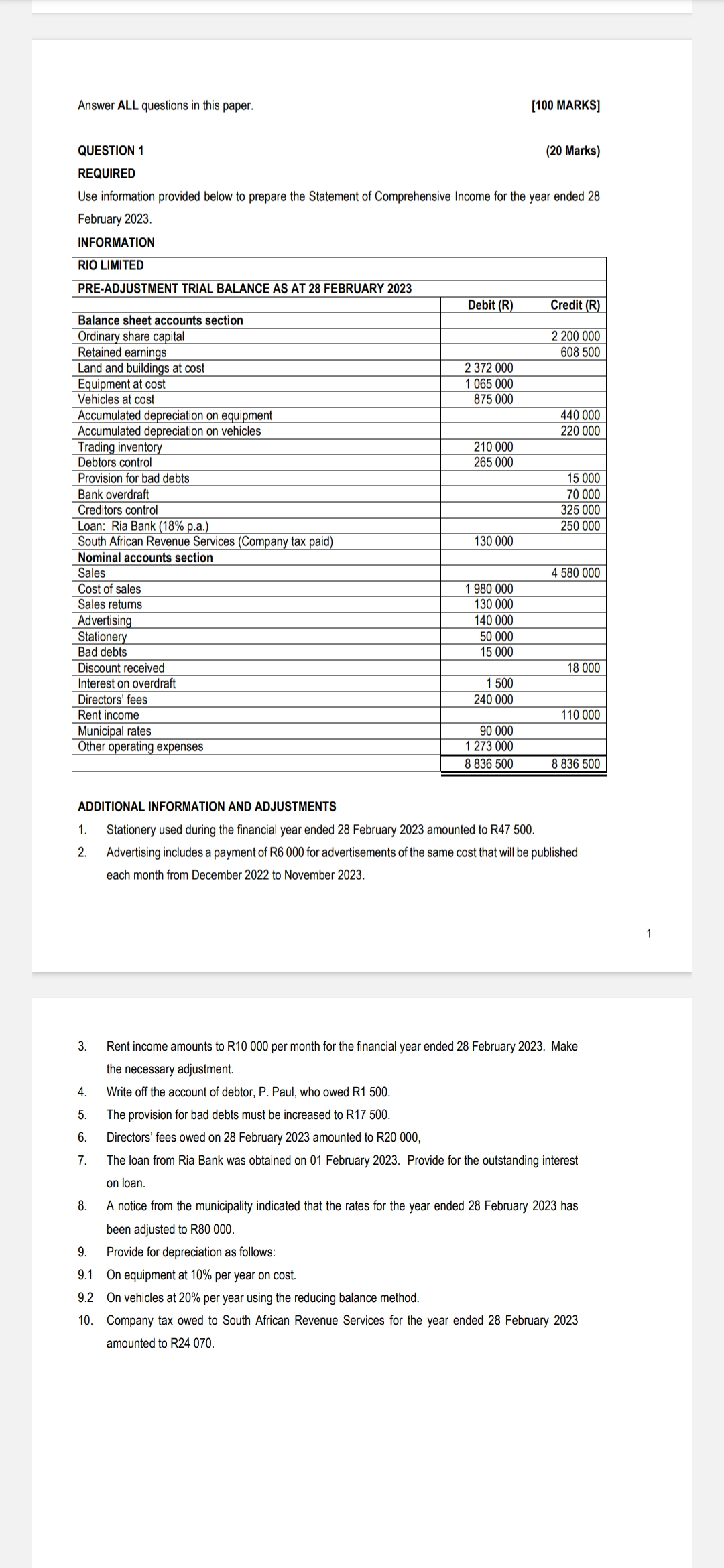

Question: QUESTION 1 (20 Marks) REQUIRED Use information provided below to prepare the Statement of Comprehensive Income for the year ended 28 February 2023. INFORMATION RIO

QUESTION 1 (20 Marks) REQUIRED Use information provided below to prepare the Statement of Comprehensive Income for the year ended 28 February 2023. INFORMATION RIO LIMITED ADDITIONAL INFORMATION AND ADJUSTMENTS 1. Stationery used during the financial year ended 28 February 2023 amounted to R47 500. 2. Advertising includes a payment of \\( \\mathrm{R} 6000 \\) for advertisements of the same cost that will be published each month from December 2022 to November 2023. 3. Rent income amounts to R10 000 per month for the financial year ended 28 February 2023. Make the necessary adjustment. 4. Write off the account of debtor, P. Paul, who owed R1 500. 5. The provision for bad debts must be increased to R17 500 . 6. Directors' fees owed on 28 February 2023 amounted to R20 000, 7. The loan from Ria Bank was obtained on 01 February 2023. Provide for the outstanding interest on loan. 8. A notice from the municipality indicated that the rates for the year ended 28 February 2023 has been adjusted to \\( \\mathrm{R} 80000 \\). 9. Provide for depreciation as follows: 9.1 On equipment at \10 per year on cost. 9.2 On vehicles at \20 per year using the reducing balance method. 10. Company tax owed to South African Revenue Services for the year ended 28 February 2023 amounted to R24 070

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts