Question: Question 1 20 points Save Answer You are a financial analyst at a major business valuation firm. You are analyzing how a change in

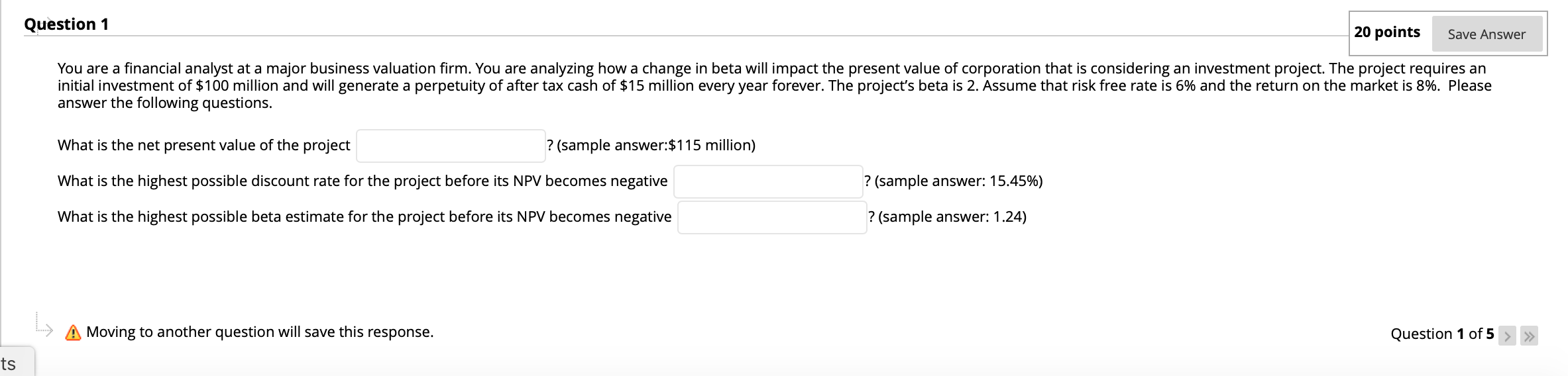

Question 1 20 points Save Answer You are a financial analyst at a major business valuation firm. You are analyzing how a change in beta will impact the present value of corporation that is considering an investment project. The project requires an initial investment of $100 million and will generate a perpetuity of after tax cash of $15 million every year forever. The project's beta is 2. Assume that risk free rate is 6% and the return on the market is 8%. Please answer the following questions. What is the net present value of the project ? (sample answer:$115 million) ? (sample answer: 15.45%) ? (sample answer: 1.24) What is the highest possible discount rate for the project before its NPV becomes negative What is the highest possible beta estimate for the project before its NPV becomes negative ts Ly Moving to another question will save this response. Question 1 of 5 > >>>

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to calculate the following 1 Net Present Value NPV of the project 2 Hi... View full answer

Get step-by-step solutions from verified subject matter experts