Question: Question 1 (25 marks) The Palm Tree Caf is considering to buy a new Coffee blending machine. Since there are many offerings, the manager asks

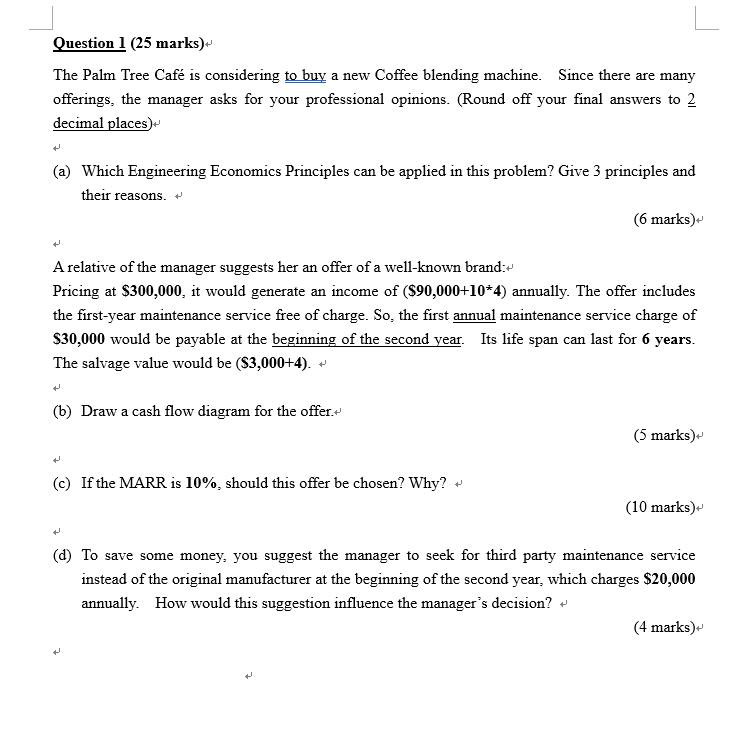

Question 1 (25 marks) The Palm Tree Caf is considering to buy a new Coffee blending machine. Since there are many offerings, the manager asks for your professional opinions. (Round off your final answers to 2 decimal places) (a) Which Engineering Economics Principles can be applied in this problem? Give 3 principles and their reasons. + (6 marks) A relative of the manager suggests her an offer of a well-known brand: Pricing at $300,000, it would generate an income of ($90,000+10*4) annually. The offer includes the first-year maintenance service free of charge. So, the first annual maintenance service charge of $30,000 would be payable at the beginning of the second year. Its life span can last for 6 years. The salvage value would be ($3,000+4). + (b) Draw a cash flow diagram for the offer. (5 marks) t (c) If the MARR is 10%, should this offer be chosen? Why? + (10 marks) (d) To save some money, you suggest the manager to seek for third party maintenance service instead of the original manufacturer at the beginning of the second year, which charges $20,000 annually. How would this suggestion influence the manager's decision? (4 marks) Question 1 (25 marks) The Palm Tree Caf is considering to buy a new Coffee blending machine. Since there are many offerings, the manager asks for your professional opinions. (Round off your final answers to 2 decimal places) (a) Which Engineering Economics Principles can be applied in this problem? Give 3 principles and their reasons. + (6 marks) A relative of the manager suggests her an offer of a well-known brand: Pricing at $300,000, it would generate an income of ($90,000+10*4) annually. The offer includes the first-year maintenance service free of charge. So, the first annual maintenance service charge of $30,000 would be payable at the beginning of the second year. Its life span can last for 6 years. The salvage value would be ($3,000+4). + (b) Draw a cash flow diagram for the offer. (5 marks) t (c) If the MARR is 10%, should this offer be chosen? Why? + (10 marks) (d) To save some money, you suggest the manager to seek for third party maintenance service instead of the original manufacturer at the beginning of the second year, which charges $20,000 annually. How would this suggestion influence the manager's decision? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts