Question: Question 1 3 Points Questions 1 through 8 are based on the following fact situation In 2019, Reid Incorporated, a manufacturer and retailer of computer

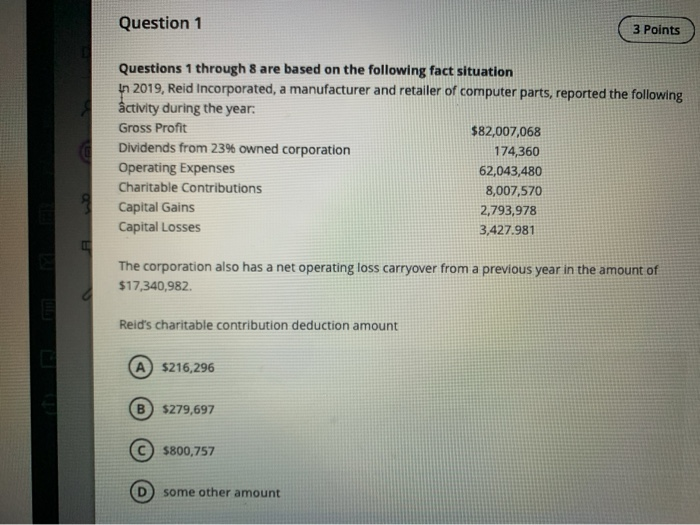

Question 1 3 Points Questions 1 through 8 are based on the following fact situation In 2019, Reid Incorporated, a manufacturer and retailer of computer parts, reported the following activity during the year: Gross Profit $82,007,068 Dividends from 23% owned corporation 174,360 Operating Expenses 62,043,480 Charitable Contributions 8,007,570 Capital Gains 2,793,978 Capital Losses 3,427.981 The corporation also has a net operating loss carryover from a previous year in the amount of $17,340,982. Reid's charitable contribution deduction amount A $216,296 ( $279,697 $800,757 some other amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts