Question: Question 1 3 pts Which is the most expensive source of capital in WACC? O bonds O preferred stocks O retained earnings O new issue

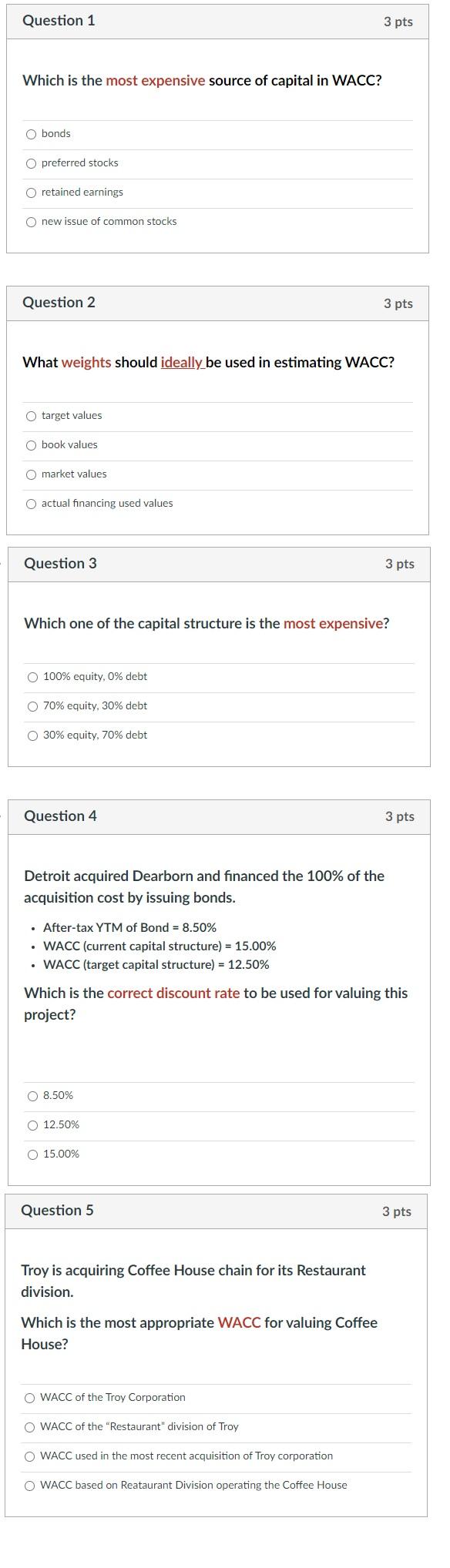

Question 1 3 pts Which is the most expensive source of capital in WACC? O bonds O preferred stocks O retained earnings O new issue of common stocks Question 2 3 pts What weights should ideally be used in estimating WACC? target values book values market values O actual financing used values Question 3 3 pts Which one of the capital structure is the most expensive? 100% equity, 0% debt O 70% equity, 30% debt O 30% equity, 70% debt Question 4 3 pts Detroit acquired Dearborn and financed the 100% of the acquisition cost by issuing bonds. After-tax YTM of Bond = 8.50% WACC (current capital structure) = 15.00% WACC (target capital structure) = 12.50% Which is the correct discount rate to be used for valuing this project? O 8.50% 12.50% 15.00% Question 5 3 pts Troy is acquiring Coffee House chain for its Restaurant division. Which is the most appropriate WACC for valuing Coffee House? O WACC of the Troy Corporation O WACC of the "Restaurant" division of Troy O WACC used in the most recent acquisition of Troy corporation O WACC based on Reataurant Division operating the Coffee House

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts