Question: Question 1 (30 Marks) a) The primary financial objective is usually taken to be the maximization of shareholder wealth. Discuss : i. Ways in which

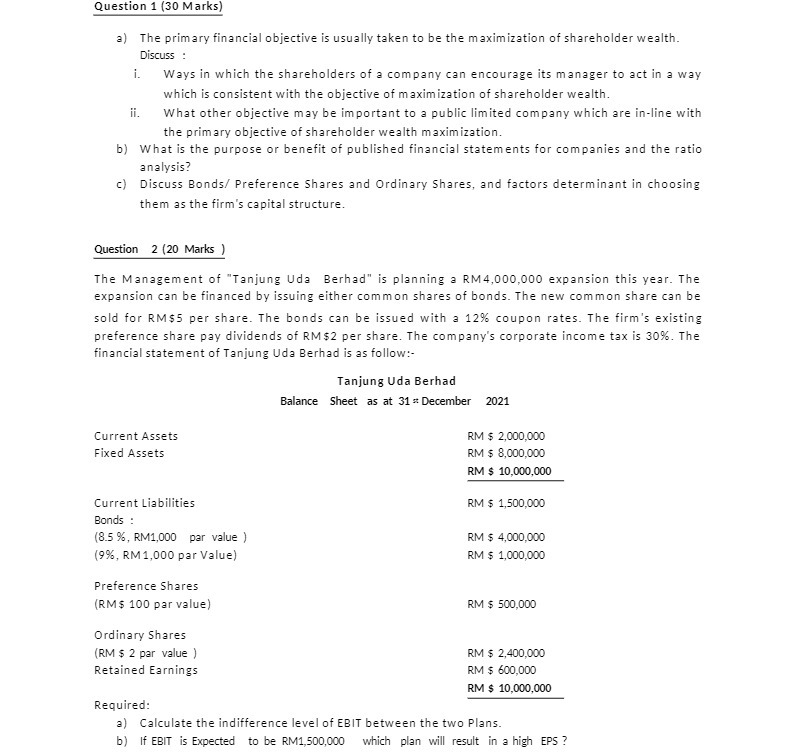

Question 1 (30 Marks) a) The primary financial objective is usually taken to be the maximization of shareholder wealth. Discuss : i. Ways in which the shareholders of a company can encourage its manager to act in a way which is consistent with the objective of maximization of shareholder wealth. ii. What other objective may be important to a public limited company which are in-line with the primary objective of shareholder wealth maximization. b) What is the purpose or benefit of published financial statements for companies and the ratio analysis? c) Discuss Bonds/ Preference Shares and Ordinary Shares, and factors determinant in choosing them as the firm's capital structure. Question 2 (20 Marks ) The Management of "Tanjung Ude Berhad" is planning a RM4,000,000 expansion this year. The expansion can be financed by issuing either common shares of bonds. The new common share can be sold for RM$5 per share. The bonds can be issued with a 12% coupon rates. The firm's existing preference share pay dividends of RM$2 per share. The company's corporate income tax is 30%. The financial statement of Tanjung Uda Berhad is as follow:- Tanjung Uda Berhad Balance Sheet as at 31 * December 2021 Current Assets RM $ 2,000,000 Fixed Assets RM $ 8,000,000 RM $ 10.000,000 Current Liabilities RM $ 1,500,000 Bonds : (8.5 %, RM1,000 par value ) RM $ 4,000,000 (9%, RM 1,000 par Value) RM $ 1,000,000 Preference Shares (RM$ 100 par value) RM $ 500,000 Ordinary Shares (RM $ 2 par value ) RM $ 2,400,000 Retained Earnings RM $ 600,000 RM $ 10,000,000 Required: a) Calculate the indifference level of EBIT between the two Plans. 6) If EBIT is Expected to be RM1,500,000 which plan will result in a high EPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts