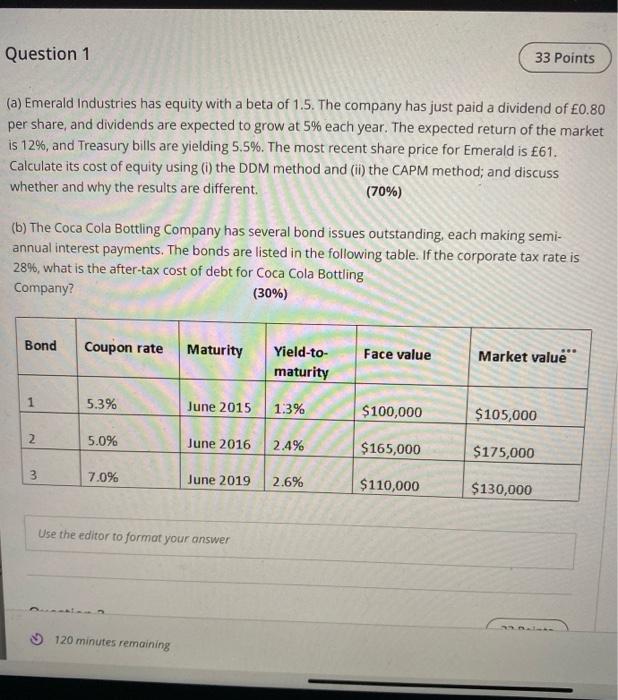

Question: Question 1 33 Points (a) Emerald Industries has equity with a beta of 1.5. The company has just paid a dividend of 0.80 per share,

Question 1 33 Points (a) Emerald Industries has equity with a beta of 1.5. The company has just paid a dividend of 0.80 per share, and dividends are expected to grow at 5% each year. The expected return of the market is 12%, and Treasury bills are yielding 5.5%. The most recent share price for Emerald is 61. Calculate its cost of equity using (1) the DDM method and (ii) the CAPM method; and discuss whether and why the results are different (70%) (b) The Coca Cola Bottling Company has several bond issues outstanding, each making semi- annual interest payments. The bonds are listed in the following table. If the corporate tax rate is 28%, what is the after-tax cost of debt for Coca Cola Bottling Company? (30%) Bond Coupon rate Maturity Yield-to- maturity Face value 900 Market value 1 5.3% June 2015 1.3% $100,000 $105,000 2. 5.0% June 2016 2.4% $165,000 $175,000 3 7.0% June 2019 2.6% $110,000 $130,000 Use the editor to format your answer 120 minutes remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts