Question: Question 1 ( 4 2 marks ) Double MM is a start - up sole trader, owned by Mandla Miller in Cape Town, Mandla has

Question

marks

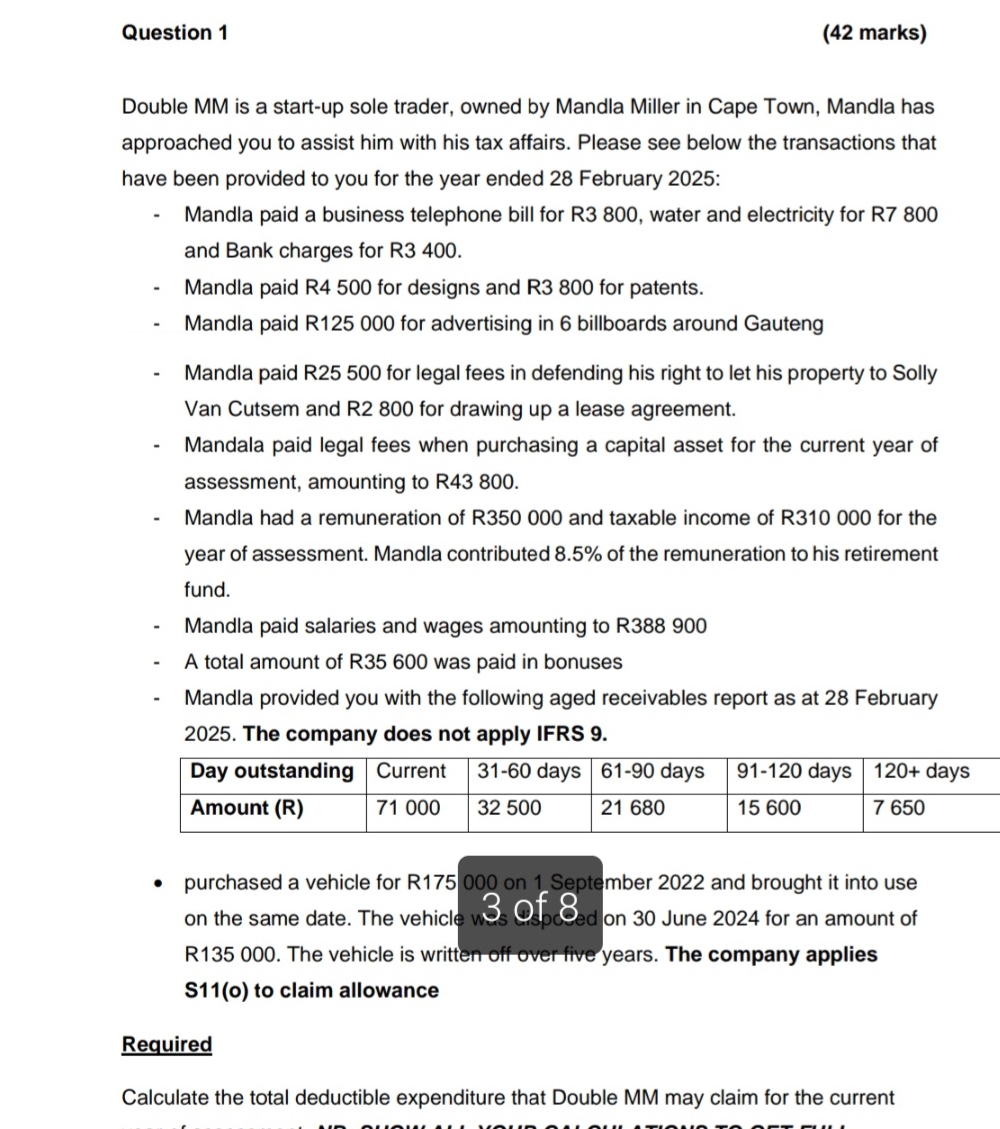

Double MM is a startup sole trader, owned by Mandla Miller in Cape Town, Mandla has approached you to assist him with his tax affairs. Please see below the transactions that have been provided to you for the year ended February :

Mandla paid a business telephone bill for R water and electricity for R and Bank charges for R

Mandla paid R for designs and R for patents.

Mandla paid R for advertising in billboards around Gauteng

Mandla paid R for legal fees in defending his right to let his property to Solly Van Cutsem and R for drawing up a lease agreement.

Mandala paid legal fees when purchasing a capital asset for the current year of assessment, amounting to R

Mandla had a remuneration of R and taxable income of R for the year of assessment. Mandla contributed of the remuneration to his retirement fund.

Mandla paid salaries and wages amounting to R

A total amount of R was paid in bonuses

Mandla provided you with the following aged receivables report as at February The company does not apply IFRS

tableDay outstanding,Current, days, days, days, daysAmount R

purchased a vehicle for R on September and brought it into use on the same date. The vehicle w Qf &ed on June for an amount of R The vehicle is written off over five years. The company applies So to claim allowance

Required

Calculate the total deductible expenditure that Double MM may claim for the current

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock