Question: Question 1 ( 4 3 marks in total ) Staples Digital is planning to open a new location soon that will be cash intensive and

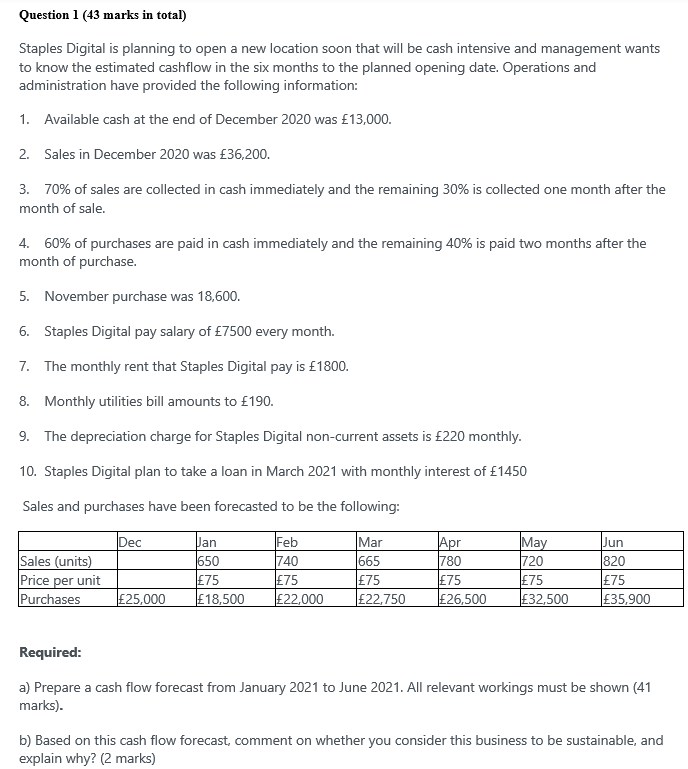

Question marks in total Staples Digital is planning to open a new location soon that will be cash intensive and management wants to know the estimated cashflow in the six months to the planned opening date. Operations and administration have provided the following information: Available cash at the end of December was Sales in December was of sales are collected in cash immediately and the remaining is collected one month after the month of sale. of purchases are paid in cash immediately and the remaining is paid two months after the month of purchase. November purchase was Staples Digital pay salary of every month. The monthly rent that Staples Digital pay is Monthly utilities bill amounts to The depreciation charge for Staples Digital noncurrent assets is monthly. Staples Digital plan to take a loan in March with monthly interest of Sales and purchases have been forecasted to be the following: Required: a Prepare a cash flow forecast from January to June All relevant workings must be shown marks b Based on this cash flow forecast, comment on whether you consider this business to be sustainable, and explain why? marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock