Question: Question 1 4 8 Points Adams Supplies Ltd . , with a taxation year that ends on December 3 1 and has a Class 8

Question

Points

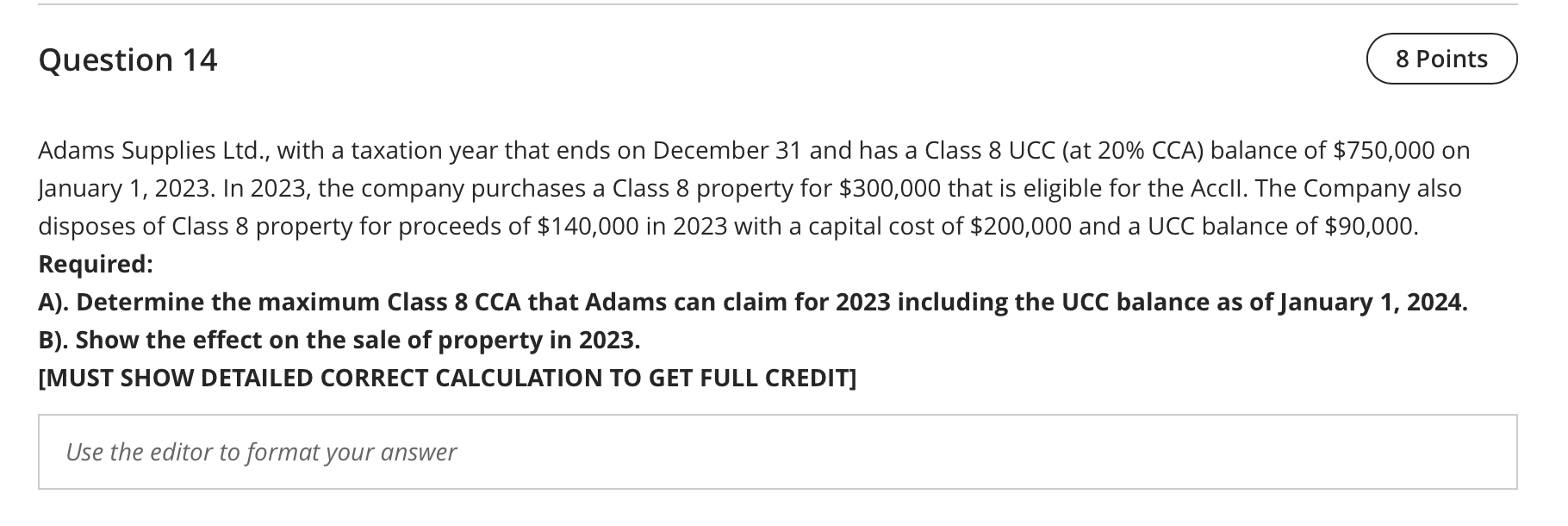

Adams Supplies Ltd with a taxation year that ends on December and has a Class UCC at CCA balance of $ on January In the company purchases a Class property for $ that is eligible for the Accll. The Company also disposes of Class property for proceeds of $ in with a capital cost of $ and a UCC balance of $

Required:

A Determine the maximum Class CCA that Adams can claim for including the UCC balance as of January

B Show the effect on the sale of property in

MUST SHOW DETAILED CORRECT CALCULATION TO GET FULL CREDIT

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock