Question: Question 1: (4 marks) The James Co. plans on saving money to buy some new equipment. The company is opening an account today with a

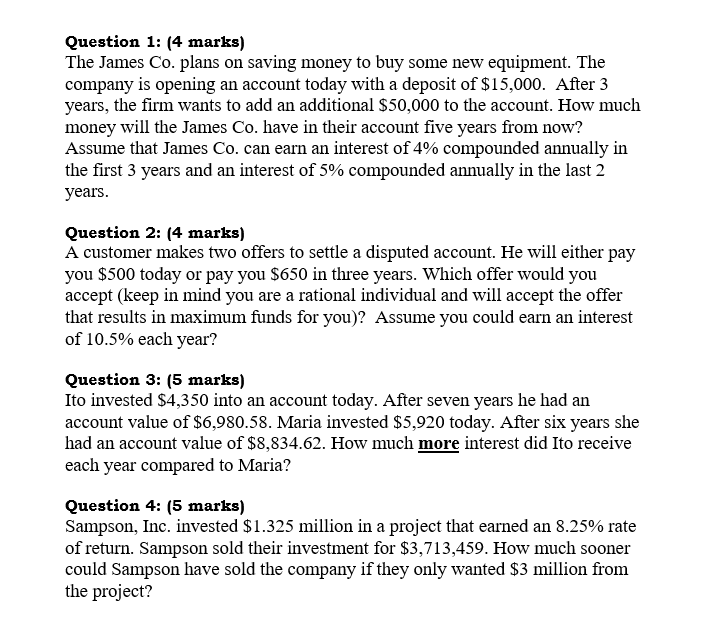

Question 1: (4 marks) The James Co. plans on saving money to buy some new equipment. The company is opening an account today with a deposit of $15,000. After 3 years, the firm wants to add an additional $50,000 to the account. How much money will the James Co. have in their account five years from now? Assume that James Co. can earn an interest of 4% compounded annually in the first 3 years and an interest of 5% compounded annually in the last 2 years. Question 2: (4 marks) A customer makes two offers to settle a disputed account. He will either pay you $500 today or pay you $650 in three years. Which offer would you accept (keep in mind you are a rational individual and will accept the offer that results in maximum funds for you)? Assume you could earn an interest of 10.5% each year? Question 3: (5 marks) Ito invested $4,350 into an account today. After seven years he had an account value of $6,980.58. Maria invested $5,920 today. After six years she had an account value of $8,834.62. How much more interest did Ito receive each year compared to Maria? Question 4: (5 marks) Sampson, Inc. invested $1.325 million in a project that earned an 8.25% rate of return. Sampson sold their investment for $3,713,459. How much sooner could Sampson have sold the company if they only wanted $3 million from the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts