Question: Use this formulas Question 1: (4 marks) The James Co. plans on saving money to buy some new equipment. The company is opening an account

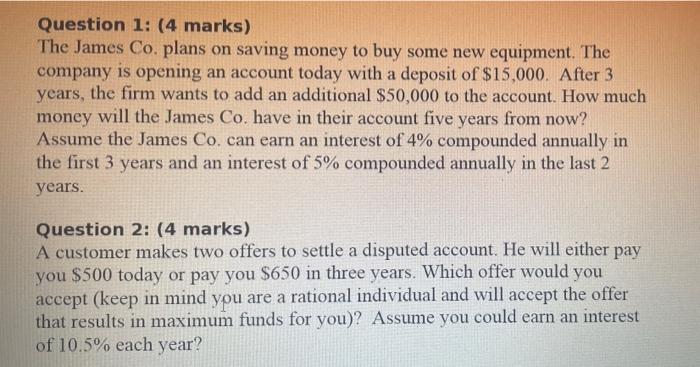

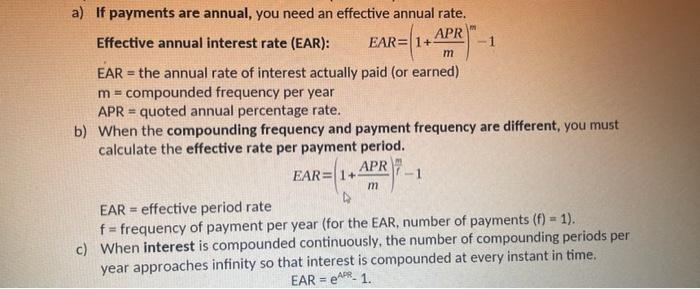

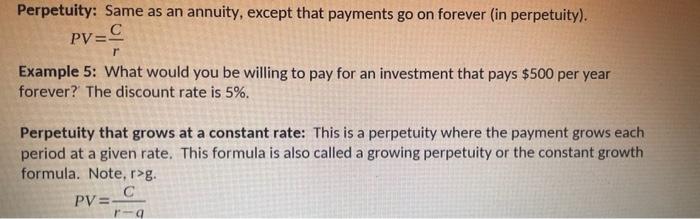

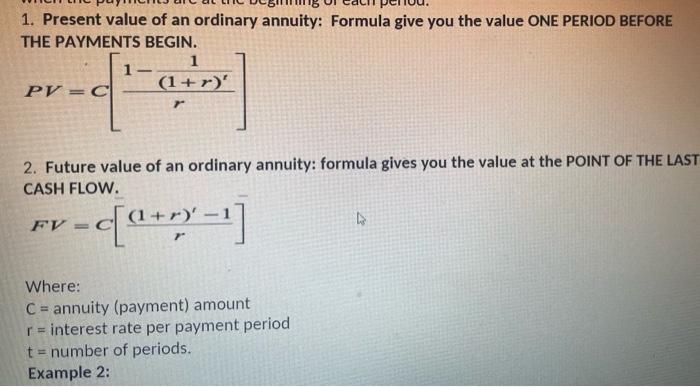

Question 1: (4 marks) The James Co. plans on saving money to buy some new equipment. The company is opening an account today with a deposit of $15,000. After 3 years, the firm wants to add an additional $50,000 to the account. How much money will the James Co. have in their account five years from now? Assume the James Co. can earn an interest of 4% compounded annually in the first 3 years and an interest of 5% compounded annually in the last 2 years. Question 2: (4 marks) A customer makes two offers to settle a disputed account. He will either pay you $500 today or pay you $650 in three years. Which offer would you accept (keep in mind you are a rational individual and will accept the offer that results in maximum funds for you)? Assume you could earn an interest of 10.5% each year? R= m a) If payments are annual, you need an effective annual rate. Effective annual interest rate (EAR): APR EAR=(1+ EAR = the annual rate of interest actually paid (or earned) m = compounded frequency per year APR = quoted annual percentage rate. b) When the compounding frequency and payment frequency are different, you must calculate the effective rate per payment period. APR EAR=1+ -1 m EAR = effective period rate f = frequency of payment per year (for the EAR, number of payments (f) = 1). c) When interest is compounded continuously, the number of compounding periods per year approaches infinity so that interest is compounded at every instant in time. EAR E APR. 1. Perpetuity: Same as an annuity, except that payments go on forever (in perpetuity). PV= r Example 5: What would you be willing to pay for an investment that pays $500 per year forever? The discount rate is 5%. Perpetuity that grows at a constant rate: This is a perpetuity where the payment grows each period at a given rate. This formula is also called a growing perpetuity or the constant growth formula. Note,r>g. PV=C ra 1. Present value of an ordinary annuity: Formula give you the value ONE PERIOD BEFORE THE PAYMENTS BEGIN. 1 1 PV = C (1+r)' - [ 2. Future value of an ordinary annuity: formula gives you the value at the POINT OF THE LAST CASH FLOW. FV = - [@+"-1] Where: C = annuity (payment) amount r = interest rate per payment period t = number of periods. Example 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts