Question: Question 1 4 pts Questions (Al-A2) are based on the information that follows. Net earnings for a constant dividend growth firm are currently $60 million

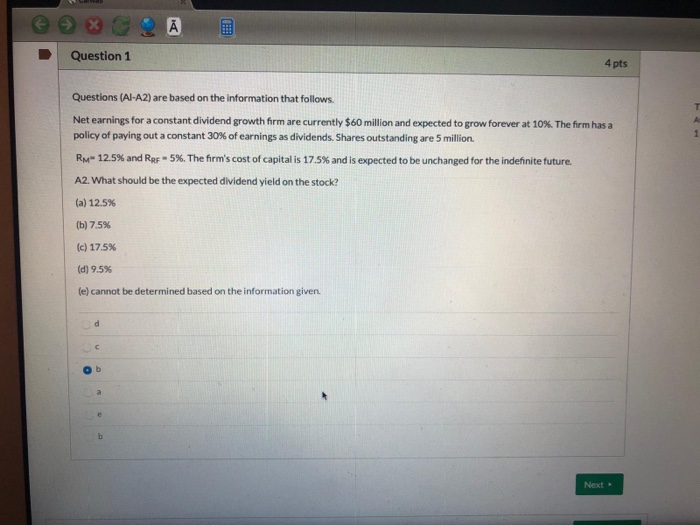

Question 1 4 pts Questions (Al-A2) are based on the information that follows. Net earnings for a constant dividend growth firm are currently $60 million and expected to grow forever at 10%. The firm has a policy of paying out a constant 30% of earnings as dividends. Shares outstanding are 5 million RM 12.5% and Res5%. The firm's cost of capital is 17.5% and is expected to be unchanged for the indefinite future. A2. What should be the expected dividend yield on the stock? (a) 12.5% (b) 7.5% (c) 17.5% (d) 9.5% le) cannot be determined based on the information given Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock