Question: Question 1 (5 marks): A decision maker has the task of designing a portfolio of stocks from different industries. Individual returns on the dollar are

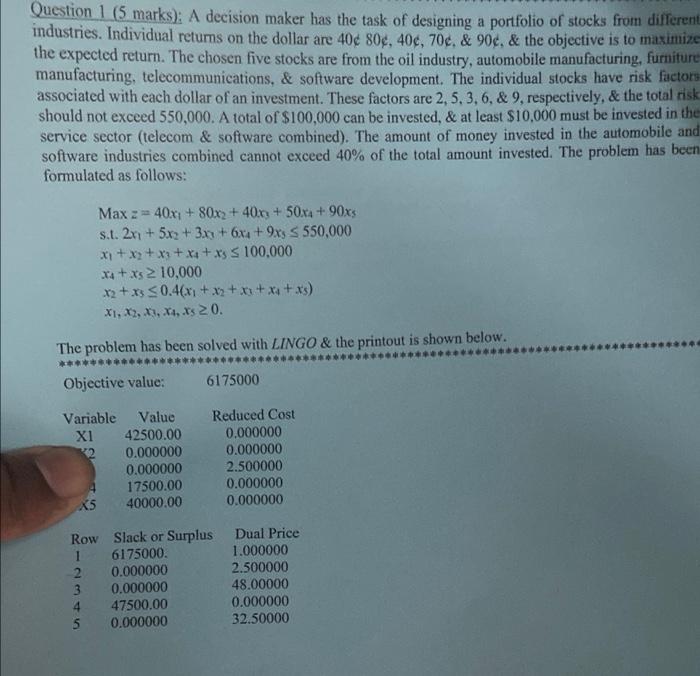

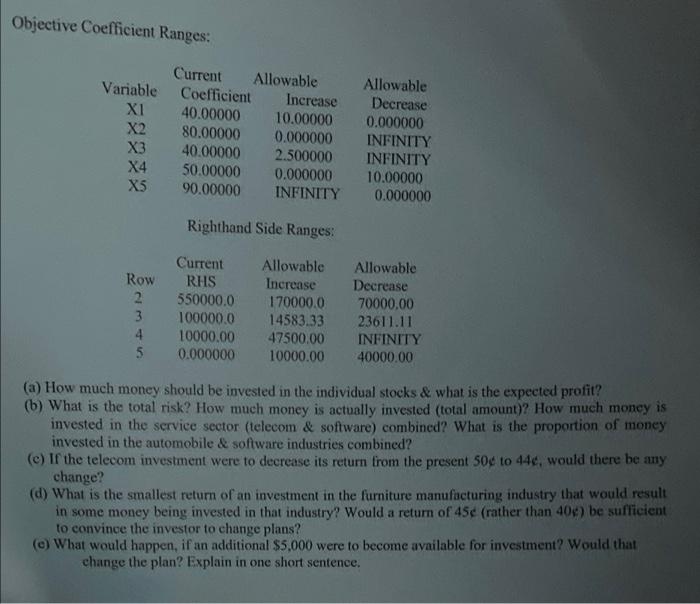

Question 1 (5 marks): A decision maker has the task of designing a portfolio of stocks from different industries. Individual returns on the dollar are 40 806, 406, 704. & 90c, & the objective is to maximize the expected return. The chosen five stocks are from the oil industry, automobile manufacturing, furniture manufacturing, telecommunications, & software development. The individual stocks have risk factors associated with each dollar of an investment. These factors are 2,5.3, 6, & 9, respectively, & the total risk should not exceed 550,000. A total of $100,000 can be invested, & at least $10,000 must be invested in the service sector (telecom & software combined). The amount of money invested in the automobile and software industries combined cannot exceed 40% of the total amount invested. The problem has been formulated as follows: Max 2 = 40x: + 80.x2 + 40x3 + 50x4 + 90xs S.L. 2x + 5x2 + 3x + 6x4 + 9xs S 550,000 x1 + x2 + x + x4 + xy S 100.000 x4+xs 10,000 x2 + x3 30.41x1 + x3 + x2 + x + xs) X1, X2, X5, X1, Xs 20. The problem has been solved with LINGO & the printout is shown below. Objective value: 6175000 Variable Value X1 42500.00 0.000000 0.000000 17500.00 40000.00 Reduced Cost 0.000000 0.000000 2.500000 0.000000 0.000000 X5 - Row Slack or Surplus 1 6175000. 2 0.000000 3 0.000000 4 47500.00 0.000000 Dual Price 1.000000 2.500000 48.00000 0.000000 32.50000 Objective Coefficient Ranges: Current Allowable Variable Coefficient Increase X1 40.00000 10.00000 X280.00000 0.000000 X3 40.00000 2.500000 X4 50.00000 0.000000 X5 90.00000 INFINITY Allowable Decrease 0.000000 INFINITY INFINITY 10.00000 0.000000 Righthand Side Ranges: Row 2 3 4 5 Current RHS 550000.0 100000.0 10000.00 0.000000 Allowable Increase 170000.0 14583.33 47500.00 10000.00 Allowable Decrease 70000.00 23611.11 INFINITY 40000.00 (a) How much money should be invested in the individual stocks & what is the expected profit? (b) What is the total risk? How much money is actually invested (total amount)? How much money is invested in the service sector (telecom & software) combined? What is the proportion of money invested in the automobile & software industries combined? (c) If the telecom investment were to decrease its return from the present 50 to 446, would there be any change? (d) What is the smallest return of an investment in the furniture manufacturing industry that would result in some money being invested in that industry? Would a return of 454 (rather than 404) be sufficient to convince the investor to change plans? (e) What would happen, if an additional $5,000 were to become available for investment? Would that change the plan? Explain in one short sentence. Question 1 (5 marks): A decision maker has the task of designing a portfolio of stocks from different industries. Individual returns on the dollar are 40 806, 406, 704. & 90c, & the objective is to maximize the expected return. The chosen five stocks are from the oil industry, automobile manufacturing, furniture manufacturing, telecommunications, & software development. The individual stocks have risk factors associated with each dollar of an investment. These factors are 2,5.3, 6, & 9, respectively, & the total risk should not exceed 550,000. A total of $100,000 can be invested, & at least $10,000 must be invested in the service sector (telecom & software combined). The amount of money invested in the automobile and software industries combined cannot exceed 40% of the total amount invested. The problem has been formulated as follows: Max 2 = 40x: + 80.x2 + 40x3 + 50x4 + 90xs S.L. 2x + 5x2 + 3x + 6x4 + 9xs S 550,000 x1 + x2 + x + x4 + xy S 100.000 x4+xs 10,000 x2 + x3 30.41x1 + x3 + x2 + x + xs) X1, X2, X5, X1, Xs 20. The problem has been solved with LINGO & the printout is shown below. Objective value: 6175000 Variable Value X1 42500.00 0.000000 0.000000 17500.00 40000.00 Reduced Cost 0.000000 0.000000 2.500000 0.000000 0.000000 X5 - Row Slack or Surplus 1 6175000. 2 0.000000 3 0.000000 4 47500.00 0.000000 Dual Price 1.000000 2.500000 48.00000 0.000000 32.50000 Objective Coefficient Ranges: Current Allowable Variable Coefficient Increase X1 40.00000 10.00000 X280.00000 0.000000 X3 40.00000 2.500000 X4 50.00000 0.000000 X5 90.00000 INFINITY Allowable Decrease 0.000000 INFINITY INFINITY 10.00000 0.000000 Righthand Side Ranges: Row 2 3 4 5 Current RHS 550000.0 100000.0 10000.00 0.000000 Allowable Increase 170000.0 14583.33 47500.00 10000.00 Allowable Decrease 70000.00 23611.11 INFINITY 40000.00 (a) How much money should be invested in the individual stocks & what is the expected profit? (b) What is the total risk? How much money is actually invested (total amount)? How much money is invested in the service sector (telecom & software) combined? What is the proportion of money invested in the automobile & software industries combined? (c) If the telecom investment were to decrease its return from the present 50 to 446, would there be any change? (d) What is the smallest return of an investment in the furniture manufacturing industry that would result in some money being invested in that industry? Would a return of 454 (rather than 404) be sufficient to convince the investor to change plans? (e) What would happen, if an additional $5,000 were to become available for investment? Would that change the plan? Explain in one short sentence

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts