Question: Question 1 5 pts Consider the following two bonds. The first has 10 years to maturity and pays a coupon rate of 10% per year.

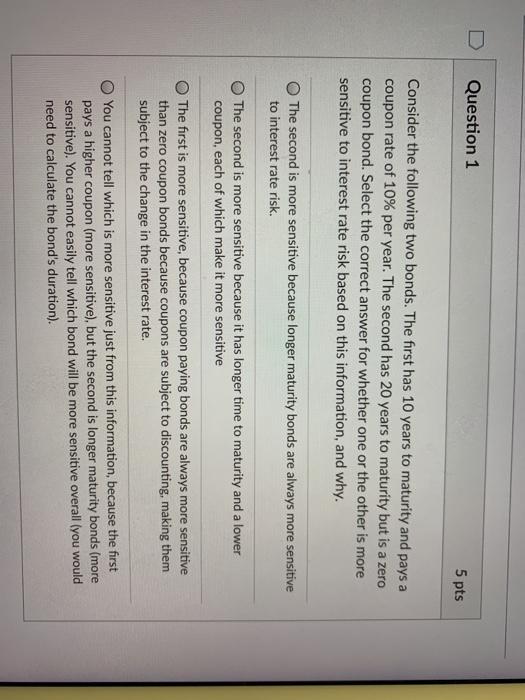

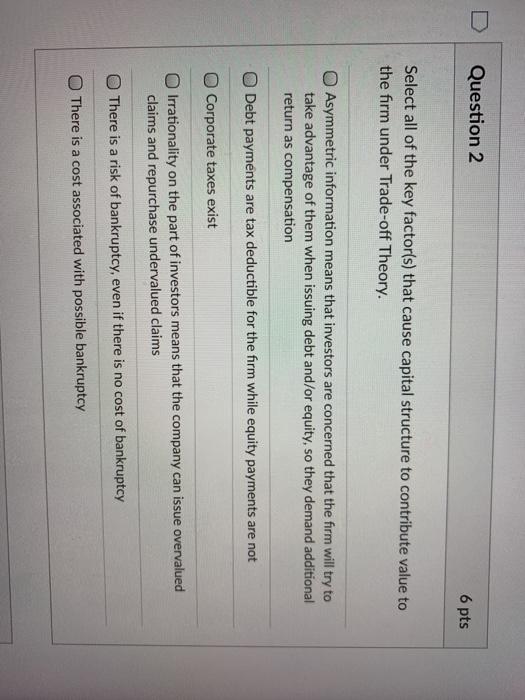

Question 1 5 pts Consider the following two bonds. The first has 10 years to maturity and pays a coupon rate of 10% per year. The second has 20 years to maturity but is a zero coupon bond. Select the correct answer for whether one or the other is more sensitive to interest rate risk based on this information, and why. The second is more sensitive because longer maturity bonds are always more sensitive to interest rate risk. The second is more sensitive because it has longer time to maturity and a lower coupon, each of which make it more sensitive The first is more sensitive, because coupon paying bonds are always more sensitive than zero coupon bonds because coupons are subject to discounting, making them subject to the change in the interest rate. You cannot tell which is more sensitive just from this information, because the first pays a higher coupon (more sensitive), but the second is longer maturity bonds (more sensitive). You cannot easily tell which bond will be more sensitive overall (you would need to calculate the bond's duration). Question 2 6 pts Select all of the key factor(s) that cause capital structure to contribute value to the firm under Trade-off Theory. Asymmetric information means that investors are concerned that the firm will try to take advantage of them when issuing debt and/or equity, so they demand additional return as compensation Debt payments are tax deductible for the firm while equity payments are not Corporate taxes exist Irrationality on the part of investors means that the company can issue overvalued claims and repurchase undervalued claims There is a risk of bankruptcy, even if there is no cost of bankruptcy There is a cost associated with possible bankruptcy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts