Question: Question 1 (6 points) Click Here to load Formula Sheet and Statistical Tables into a new tab. Keep the tab open for reference while answering

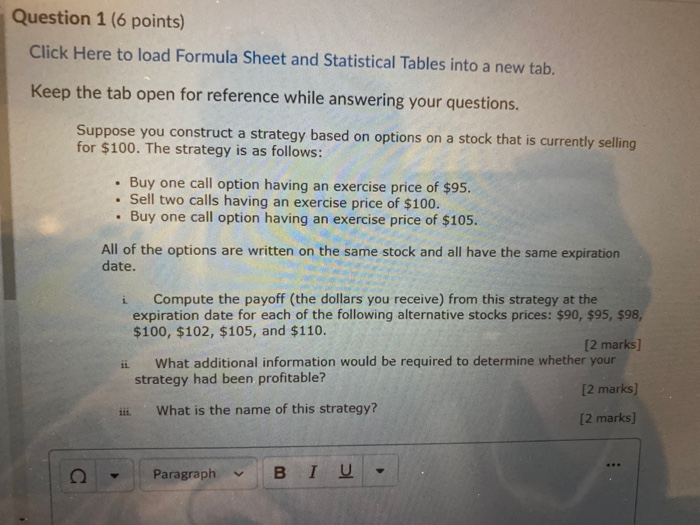

Question 1 (6 points) Click Here to load Formula Sheet and Statistical Tables into a new tab. Keep the tab open for reference while answering your questions. Suppose you construct a strategy based on options on a stock that is currently selling for $100. The strategy is as follows: . . Buy one call option having an exercise price of $95. Sell two calls having an exercise price of $100. Buy one call option having an exercise price of $105. All of the options are written on the same stock and all have the same expiration date. Compute the payoff (the dollars you receive) from this strategy at the expiration date for each of the following alternative stocks prices: $90, $95, $98, $100, $102, $105, and $110. [2 marks] What additional information would be required to determine whether your strategy had been profitable? [2 marks] What is the name of this strategy? [2 marks] i. ii. Paragraph BI U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts