Question: Question 5 (6 points) Saved Click Here to load Formula Sheet and Statistical Tables into a new tab. Keep the tab open for reference while

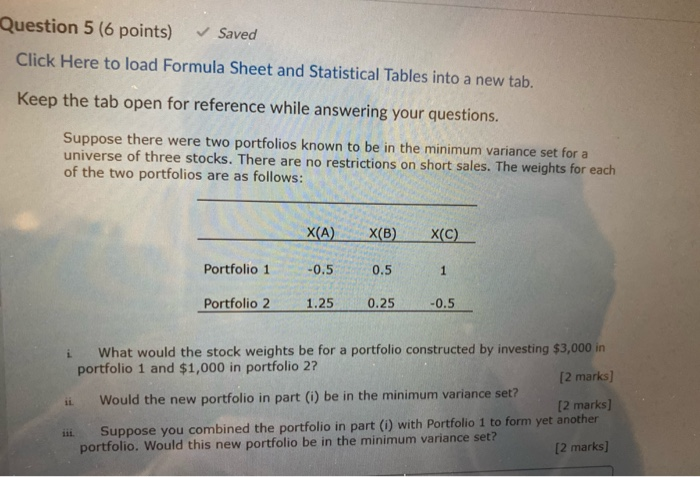

Question 5 (6 points) Saved Click Here to load Formula Sheet and Statistical Tables into a new tab. Keep the tab open for reference while answering your questions. Suppose there were two portfolios known to be in the minimum variance set for a universe of three stocks. There are no restrictions on short sales. The weights for each of the two portfolios are as follows: X(A) XB) X(C) Portfolio 1 -0.5 0.5 1 Portfolio 2 1.25 0.25 -0.5 i What would the stock weights be for a portfolio constructed by investing $3,000 in portfolio 1 and $1,000 in portfolio 2? [2 marks] Would the new portfolio in part (i) be in the minimum variance set? [2 marks] Suppose you combined the portfolio in part (i) with Portfolio 1 to form yet another portfolio. Would this new portfolio be in the minimum variance set? [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts