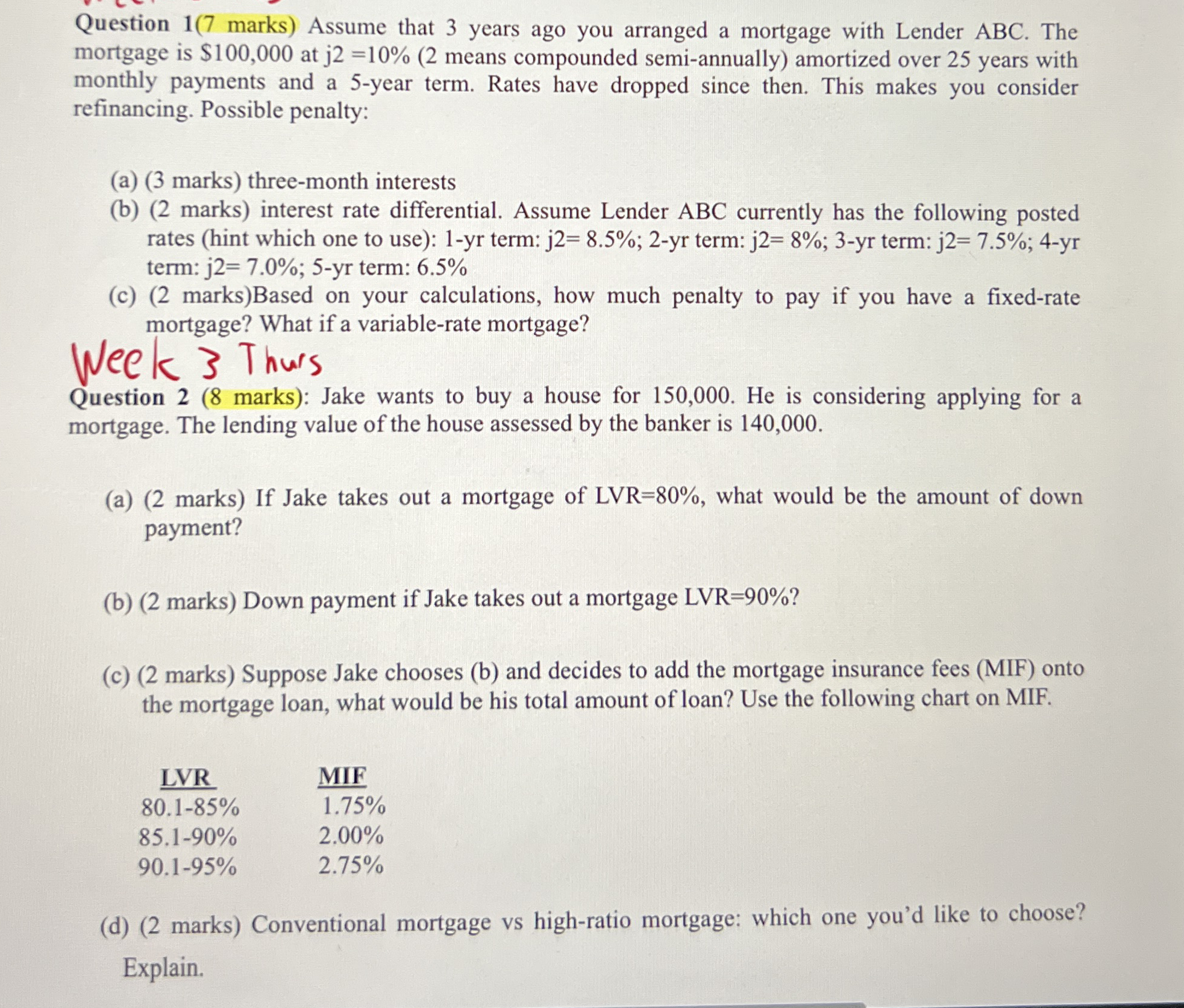

Question: Question 1 ( 7 marks ) Assume that 3 years ago you arranged a mortgage with Lender ABC . The mortgage is $ 1 0

Question marks Assume that years ago you arranged a mortgage with Lender ABC The mortgage is $ at means compounded semiannually amortized over years with monthly payments and a year term. Rates have dropped since then. This makes you consider refinancing. Possible penalty:

a marks threemonth interests

b marks interest rate differential. Assume Lender ABC currently has the following posted rates hint which one to use: yr term: ;yr term: ;yr term: ;yr term: j; yr term:

c marksBased on your calculations, how much penalty to pay if you have a fixedrate mortgage? What if a variablerate mortgage?

Week Thus

Question marks: Jake wants to buy a house for He is considering applying for a mortgage. The lending value of the house assessed by the banker is

a marks If Jake takes out a mortgage of LVR what would be the amount of down payment?

b marks Down payment if Jake takes out a mortgage LVR

c marks Suppose Jake chooses b and decides to add the mortgage insurance fees MIF onto the mortgage loan, what would be his total amount of loan? Use the following chart on MIF.

tableLVRMIF

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock