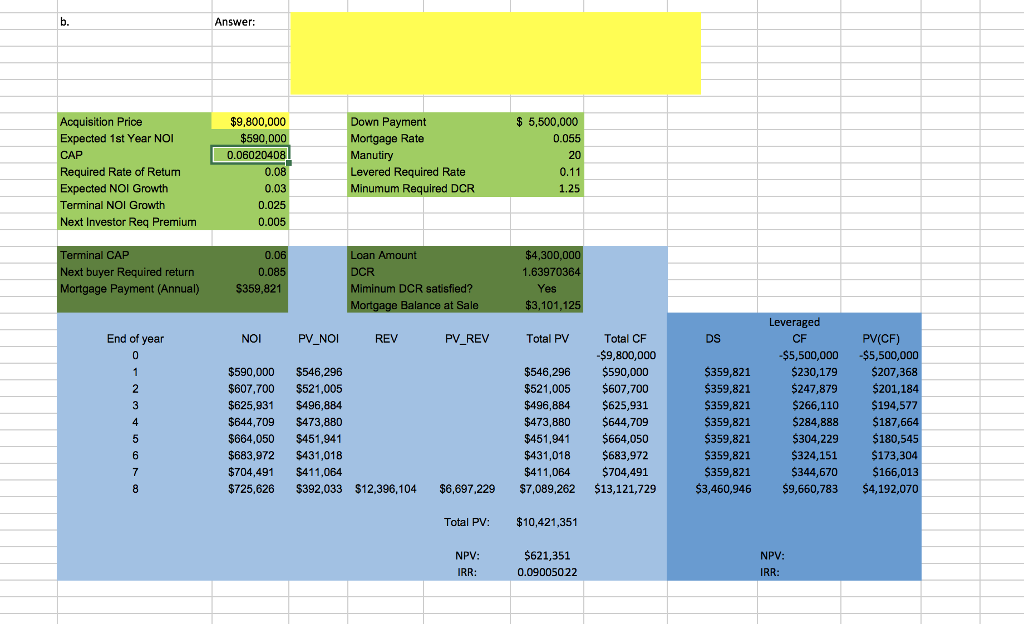

Question: Question 1 - (7 points, 4+3) Consider the levered DCF model provided to you in tab A3 of the Excel spreadsheet. a. Calculate the maximum

Question 1 -

(7 points, 4+3) Consider the levered DCF model provided to you in tab A3 of the Excel spreadsheet.

a. Calculate the maximum price that an investors with the assumptions made in the model should be willing to pay for that property. Show this maximum price in cell C8.

b. If you expect a general increase in the risk premium for real estate investments over the next 8 years, how would this affect the expected levered return on this property? Briefly Explain.

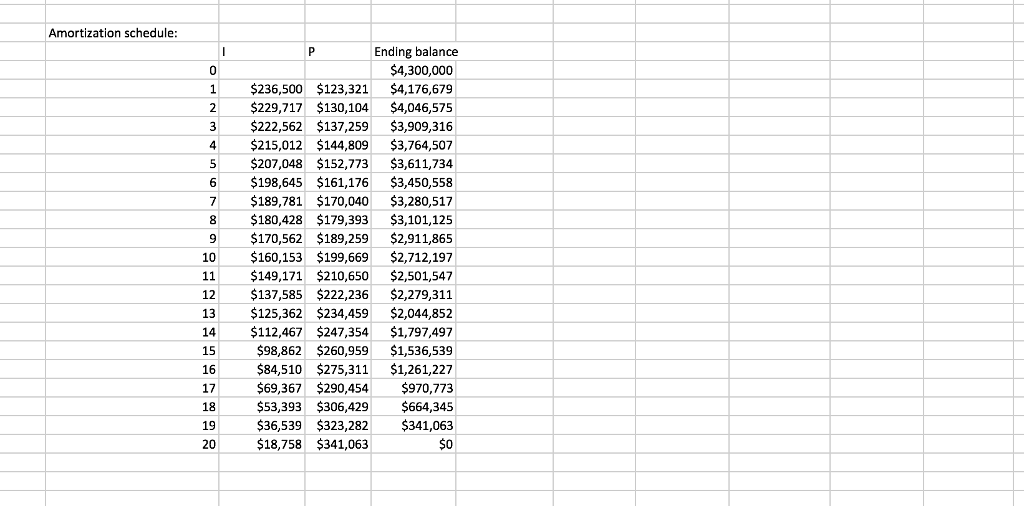

Answer: uisition Price $9,800,000 Payment $5,500,000 0.055 20 Expected 1st Year NO $590,0 Mortgage Rate Manutiry Required Rate of Retum Expected NOI Growth Terminal NOI Growth 0.06020408 0.08 0.03 0.025 d Required Rate 0 inumum Required DCR xt Investor Req Premium xt buyer Required returr ortgage Payment (Annual) 1.6397 Yes 0.085 $359,821 iminum DCR satisfied? PV(CF) $5,500,000 $5,500,0 End of year PV NOI PV REV Total PV Total CF $9,800,000 NOI DS CF $590,000 $546,296 $607,700 $521,005 $625,931 $496,884 $644,709 $473,880 $664,050 $451,941 $683,972 $431,018 $704,491 $411,064 $725,626 $392,033 $12,396,104 $6,697,229 $7,089,262 $13,121,729 $546,296 $590,000 $521,005 $607,700 $496,884 $625,93 $473,880 $644,709 $451,941 $431,018 $683,972 $411,064 $704,491 $359,821 $359,821 $359,821 $359,821 $359,821 $359,821 $359,821 $230,179 $207,368 $247,879 $266,110 $194,577 $284,888 $187,6 304,229 $324,151 $344,670 $201,18 $180,545 $173,304 $166,013 $3,460,946 $9,660,783 $4,192,070 $664,050 Total PV: $10,421,351 $621,351 0.09005022 NPV: NPV Answer: uisition Price $9,800,000 Payment $5,500,000 0.055 20 Expected 1st Year NO $590,0 Mortgage Rate Manutiry Required Rate of Retum Expected NOI Growth Terminal NOI Growth 0.06020408 0.08 0.03 0.025 d Required Rate 0 inumum Required DCR xt Investor Req Premium xt buyer Required returr ortgage Payment (Annual) 1.6397 Yes 0.085 $359,821 iminum DCR satisfied? PV(CF) $5,500,000 $5,500,0 End of year PV NOI PV REV Total PV Total CF $9,800,000 NOI DS CF $590,000 $546,296 $607,700 $521,005 $625,931 $496,884 $644,709 $473,880 $664,050 $451,941 $683,972 $431,018 $704,491 $411,064 $725,626 $392,033 $12,396,104 $6,697,229 $7,089,262 $13,121,729 $546,296 $590,000 $521,005 $607,700 $496,884 $625,93 $473,880 $644,709 $451,941 $431,018 $683,972 $411,064 $704,491 $359,821 $359,821 $359,821 $359,821 $359,821 $359,821 $359,821 $230,179 $207,368 $247,879 $266,110 $194,577 $284,888 $187,6 304,229 $324,151 $344,670 $201,18 $180,545 $173,304 $166,013 $3,460,946 $9,660,783 $4,192,070 $664,050 Total PV: $10,421,351 $621,351 0.09005022 NPV: NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts